It’s easier than you think to earn a Certified Management Accountant or Certified Public Accountant. In fact, there are just a few skills you need to be successful:

- Good with other people’s money

- Whiz with a calculator

- Penchant for giving advice

Okay, so it’s a little more complicated than that. However, if you’re good with numbers and you have the desire to learn, you have the bare bones of what it takes to become a CMA or CPA.

It gets better: we have all the know-how you need, and we’re going to share it with you today.

Let’s dive in.

What is a CMA (Certified Management Accountant)?

Management accounting is a bit different in that than financial accounting since it focuses on internal operations instead of external ones.

Both the CPA and the CMA help clients make financial choices. CMAs help companies make strategic financial management decisions by analyzing corporate strategies such as cost management such as budgets and by completing risk management duties.

CMAs work for private businesses, public companies, and even government agencies. They play a critical role in ensuring that a business makes sound financial decisions that help them remain profitable and stay in compliance with local and federal regulations in their industry.

Here are a few vital skills that a CPA needs to be successful:

Take $600 Off Surgent CMA Ultimate Pass

Flash Sale – Take $500 Off UWorld CMA Elite-Unlimited Course

What is a CPA (Certified Public Accountant)?

In a nutshell, CPAs are accountants that completed targeted education to offer specialized services to their clients.

It’s important to note that certified public accountant is not a job title. Rather, the term denotes that an individual has pursued the education and certification required to provide a unique set of financial or managerial accounting expertise.

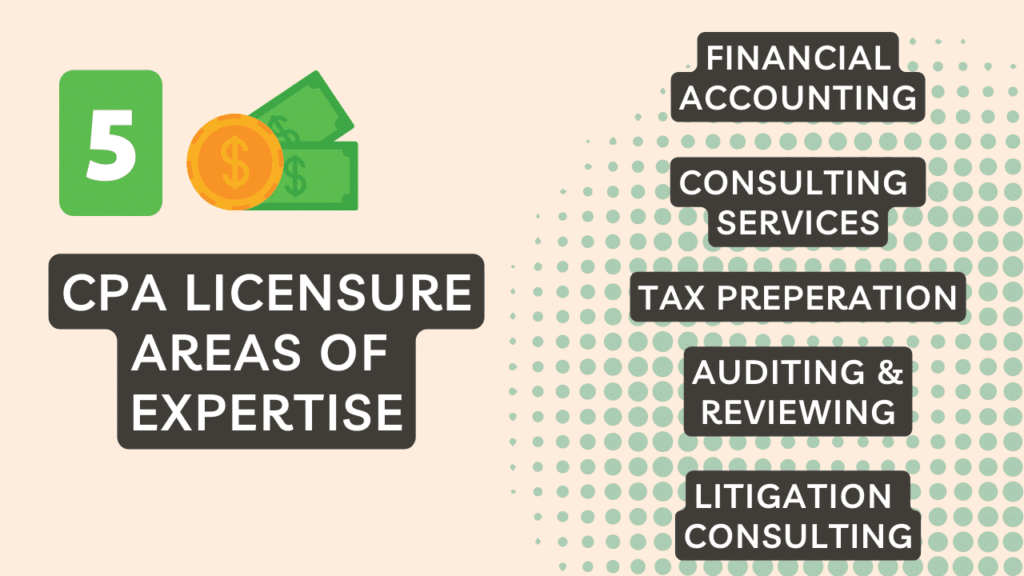

Once certified public accountants obtain their CPA license designations, they often work in roles where they perform public accounting duties such as financial statement analysis, performing audits, managing taxes and tax compliance, creating budgets, consulting clients on financial matters, and providing financial advice.

Most people who seek out a CPA certification do so to offer financial accounting services that help them earn more money. It’s also a great way for accounting professionals to focus on continuing education while growing in their field.

Take $1,600 Off UWorld CPA Elite-Unlimited Course

CPA vs CMA: Which Accounting Designation is Right for You?

You might be wondering: which accounting designation is best for me?

Many accounting students struggle with this decision.

Choosing the right accounting designation for you depends on the type of work you’d like to pursue after obtaining your accounting certification.

It’s important to note that each certification comes with its own benefits. The best way to choose which one is right for you is not by weighing which one is better.

Instead, you’ll need to consider which certification better aligns with your career goals and individual interests.

If you want to work in public finance or public accounting, the CPA certification is the best option for you. With this knowledge and education, you can expect to complete tasks such as:

- Accounting and tax services

- Consulting

- Auditing and attestation

On the other hand, if your dream is to work alongside corporations and other business entities, the CMA certification would be better suited for you.

What’s the Difference Between CPA vs. CMA?

Although CMA and CPA designations are similar, there are several differences between the two. For example, CMA professionals focus primarily on helping corporations and businesses make the right financial decisions for them.

Though CPAs offer some financial consulting, their duties are focused more on tax preparation and consulting services. CPAs also more commonly work with clients such as individual taxpayers and non-profit organizations rather than large companies.

Simply put: CPAs focus on general tax and auditing, while CMAs are management accountants that take on a wide range of other duties, as well.

Another major difference between the two is the requirements necessary to earn each designation.

CPA vs. CMA Requirements

The good news is that the basic requirements for the CMA vs. CPA are the same. You’ll first need to earn a Bachelor’s degree in Accounting or Finance. Then, you’ll need to complete the applicable American Institute exam.

Let’s take a more in-depth look at the CMA exam vs. the CPA exam (CPA licensure.)

CPA vs. CMA Exam

Regardless of which certification path you choose, you’ll need to prove your knowledge by passing an exam. Though both certifications have this requirement in common, there are several differences in this arena that you should be aware of.

Let’s take an in-depth look at the exam requirements you’ll need to meet for each exam.

CMA Exam

The CMA exam is a two-part test that is designed to ensure hopeful management accountants have an in-depth understanding of the concepts needed to obtain the certification. The exam is split into two parts, with each part lasting four hours.

Part one of the CMA exam covers performance, analytics, and financial planning. Part two covers strategic financial management. Each section includes 100 multiple-choice questions, and two 30-minute essay prompts, and test takers can take the sections in any order.

Since the test is timed, test takers have three hours to complete the multiple-choice questions before moving on to the essay prompts; however, to be eligible to take the essays, test takers must score over 50% on the MCQ portion.

The average pass rate for the CMA exam is around 45%, meaning the CMA exam difficulty causes 55% of first-time test takers to fail.

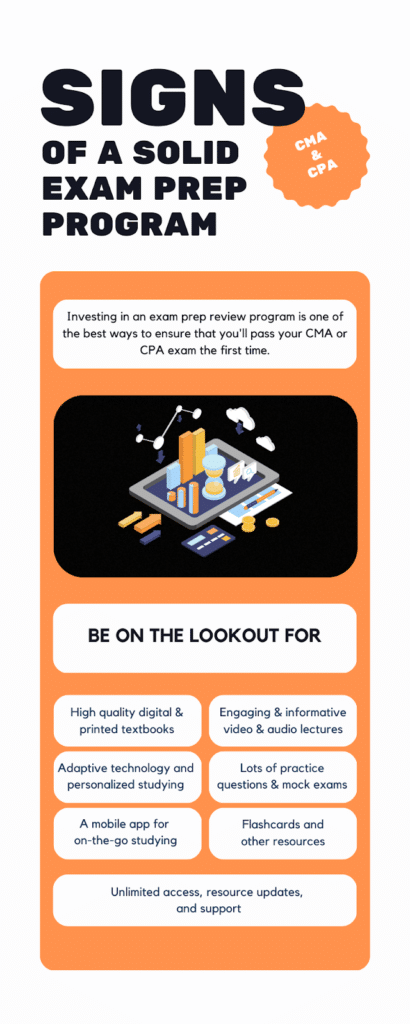

You might be wondering how to pass the CMA exam. The best way to increase your chances of passing on your first attempt is by preparing adequately for the exam. Taking advantage of test prep resources and enrolling in a CMA certification program is a great place to start.

Of course, this raises your CMA exam cost budget, but it’s well worth it. Both CPA and CMA exams have enrollment fees, and taking them over and over can get expensive.

Plus, they’re only offered a few times a year.

CMA exams are administered during the following timeframes:

- January-February

- May-June

- September-October

Once you’re registered, you’ll contact Prometric to schedule the exact date of your exam.

Failure to schedule an appointment will result in the forfeiture of any exam fees paid. If you need to reschedule for any reason, make sure to place a request at least 72 prior to your appointment to avoid losing your exam fees.

CPA Exam

The CPA exam has four sections that cover each of the various duties you’ll perform after earning your certification. Each state has its own eligibility requirements to practice public accounting duties, but you can expect to need to meet these standard criteria:

- A bachelor’s degree in accounting

- 1-2 years of working experience

You will have one hour to complete four sections of the CPA exam (out of a total of six). However, the American Institute of Certified Public Accountants only requires you to complete one section at a time. What’s even more exciting is that you don’t have to complete the test sections in any specific order. That means you’ll have the flexibility to work on the section you feel the most prepared for each time you make a test appointment.

Let’s take a more in-depth look at each of the test sections you’ll need to become a licensed CPA:

- Auditing and Attestation (AUD)

- Taxation and Regulation (REG)

- Financial Accounting and Reporting (FAR)

- Discipline Sections (Choose One)

- Business Analysis and Reporting (BAR)

- Information Systems and Controls (ISC)

- Tax Compliance and Planning (TCP)

All sections include a mix of multiple-choice questions and task-based simulations.

CPA scores range anywhere from 0 to 99 and have a minimum passing score of 75. This score is tabulated based on a weighted combination of scaled scores. Since the CPA exam is so comprehensive, it’s essential to put plenty of effort into preparation.

Exam preparation courses and study guides are not part of the CPA requirements, but most people have a hard time passing the CPA exams without them.

CMA and CPA Exam Difficulty

The easiest way to gauge exam difficulty when comparing the CMA and CPA exams is by looking at the pass rate.

The current CMA pass rate is 45%, while the CPA pass rate is currently around 54%. As these numbers suggest, the tests are rigorous, and it’s not uncommon for students and professionals to require retakes before ultimately earning their certifications.

Why do people fail?

There are many reasons why examinees fail the CPA and CMA exams and miss earning their accounting certifications. These include:

- Not allocating enough time for studying

- Not being familiar with the topics

- Not being familiar with the test formatting

- Lacking confidence on test day

Certified public accountants and management accountants alike can benefit from putting lots of time and energy into studying.

CPA vs. CMA Cost of Certification

Since you’re into financial planning, you’re probably wondering how much it costs to become certified as a CPA or CMA. Luckily, you won’t need to break out your calculator to find out – we’ve compiled all the information for you.

Even though there is a cost involved in obtaining your CPA or CMA certification, the skills and qualifications you’ll gain make it well worth the investment.

Let’s take a closer look.

CPA Cost of Certification

The first sizeable cost associated with becoming a CPA is college. Since you’ll need a bachelor’s or master’s degree in accounting, you’ll need to invest in high-quality education that equips you with the tools you need to succeed.

The average cost of tuition varies, but you can expect to pay anywhere between $10,950 to $39,400 per year for four years of college. The price you’ll pay depends on your choice of university, where you choose to live, and whether you’re already a resident in the state where your university is.

Then, you’ll need to pay to prepare and take the CPA exam. Since the best way to get ready for the test is by studying, it’s a good idea to invest in a CPA review course to guide you. Since there’s no one-size-fits-all course, you’ll need to weigh the costs versus the benefits to choose the right option for you.

Next, you’ll pay the cost of the CPA exam itself. Each state has its own exam fee, so make sure to check with your to find out what that looks like for your state. For this example, we’ll break down the exam fees for a student in New York:

- Initial Application Fee: $170

- Application Fee for Retakes: $85

- CPA Exam Fees: $225 per section

- Total Cost: $1070

Once you remit payment for the CPA licensing fees, you’ll have a limited amount of time to complete the exams you’ve paid for. While you do have the option to pay for all four up front, it’s not recommended. Remember: the test is long and is designed to test your mastery of complicated processes.

Failing just one section will hold you back from obtaining your certification.

That’s why it’s recommended to instead pay for one to two exam sections at a time. This allows you the full testing timeframe for retakes, which increases your chances of securing the certification in the shortest amount of time possible.

Congratulations – you passed your exam! Now, it’s time to make it official. Many states require students to take an ethics exam before they can obtain their licensure. If the state you live in has this requirement, you can expect to pay a fee for testing. It’s also likely that you’ll need to pay to retake the test on a pre-determined schedule to keep your license.

Let’s continue with our example of obtaining licensure in New York. When submitting an Application for Licensure, applicants must pay a first-time registration fee of $427.

CMA Cost of Certification

As is the case for the CPA certification, you’ll need to earn a Bachelor’s degree in Accounting before you can pursue a Certified Management Accountant certification. To recap, the average cost of college ranges from $10,950 to $39,400, based on a number of factors, including your university of choice and residency status in the state where it’s located.

It’s also important to keep in mind that the CMA exam is not easy. Many students need several attempts before earning a passing score. One of the most effective ways to improve your chances of passing on the first try is by enrolling in a dedicated review course.

Though this will increase your overall investment, you’re likely to save money in the long run since adequate preparation reduces your chances of needing to pay for multiple retakes.

In addition to testing fees, you’ll also be required to pay an annual Institute of Management Accounts (IMA) subscription fee, which varies:

- Professional: $260

- Student: $45

- Academic: $135

There is also a one-time $15 processing fee for Professional and Academic IMA memberships.

After becoming certified as a CMA, you’ll be required to complete a minimum of 30 hours of continuing education courses per year. The average yearly cost of these online classes is around $1,000.

CMA vs. CPA Earning Potential

While there’s no doubt that it’s expensive to become a CMA or CPA, the earning potential you’ll have after completing your education and certification makes it well worth it.

The average yearly salary for individuals is based on a variety of factors such as education, experience, employer, and even location. However, on an average salary, CMAs earn around $85,000 per year, while CPAs earn about $73,800 yearly starting out. These numbers climb with experience and continuing education, with top-earning CMAs pulling in over $140,000 annually and CPAs earning over $124,000 a year.

CPA vs. CMA FAQ

A: If you’re looking for a way to break into accounting in a business environment, earning your CMA certification is well worth it. With the knowledge and expertise you’ll gain, you can solidify yourself as a master in the field.

A: Both the CPA and CMA certifications offer their own set of unique benefits. You’ll need to consider your personal career goals and interests to choose which one is right for you. If you want to work with internal financial processes or strategic management, choose CMA. If you want to focus on external processes, take the CPA exam.

A: The CMA certification is usually considered easier when compared to the CPA certification. This is because even though the training and experience required are similar, the CPA exam is twice as long as the CMA exam.

Sources: