The AUD test is one of four sections of the Uniform CPA Examination. Short for Auditing and Attestation, the Audit exam covers several types of communications that auditors must make without outside parties.

CPA candidates need to understand these important concepts if they want to pass their exam and become a Certified Public Accountant. This test is far from easy so it’s important that students prepare for it very seriously.

Sounds tough, right? Well don’t worry; we’re here to help!

Take a look at this mega-guide we’ve put together that will prepare you for many of the difficult concepts and terms associated with the AUD CPA exam. You’ll be a master auditor in no time!

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2025

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Gleim CPA Review Course ◄◄ Most Practice Questions

9 Auditor Communications You Should Know

Right off the bat, one of the most important things an auditor needs to master is communication.

While an audit requires extensive communication within audit team, the CPA firm must also have conversations with the client, potential clients, and possibly with predecessor auditors.

Use the tips below to help you understand nine important communications between auditors and other parties.

Before Accepting the Engagement

Auditors must talk with the every potential client before agreeing to perform an audit of their financial statements.

Furthermore, there are several questions that must be answered before audit work can begin:

#1- Circumstances for an adequate audit

Circumstances must exist that allow the auditor to perform the necessary audit work. Specifically, the auditor needs access to all source documents (receipts, invoices, etc.), the general ledger, and the financial statements generated for the year.

Auditors also need access to the client’s staff so that they can ask questions about transactions, company policy, and other issues. If, for example, the auditor cannot access shipping documents that prove when goods were shipped to customers, the auditor may not have enough audit evidence to confirm the sales and accounts receivable balances at year-end.

#2- Explaining an unqualified opinion

Additionally, an auditor needs to discuss the type of audit opinions with the client, and the potential impact on company stakeholders.

The best outcome for an audit is for the auditor to issue an unqualified opinion, which states that the financial statements are free of any material misstatements. Material, in this case, means that the auditor did not find any errors that were large enough to change the opinion of the financial statement reader.

Essentially, materiality is a judgment made by the auditor. For example, A $50 error in a $3 million accounts receivable balance may not be material, but a $10,000 error might be.

Consequently, in order to issue an unqualified opinion the auditor must have access to all records and to company management. Furthermore, the audit evidence must support the unqualified opinion, and these facts must be explained to the client.

#3- Discussing a qualified opinion

What is perhaps more important is that the auditor must explain that audit evidence may require the audit to issue a qualified opinion. This is also commonly referred to as an “except for” opinion.

Assume, for example, that the auditor was not able to perform a physical count of inventory near the balance sheet date: the date used on the balance sheet that is under audit. An inventory count is considered the best evidence to support the inventory balance. Hence, the auditor may conclude that other procedures are not sufficient to support the inventory balance.

If this case, the auditor may issue an opinion which states that, except for the inventory balance, the financial statements are free of material misstatement. Unfortunately, a qualified opinion can have a negative impact on stakeholders, such as investors and creditors. This is because it raises concerns about the accuracy of the financial statements.

There are several other types of opinions that an auditor may issue on the financial statements. Consequently, the client must clearly understand each type of audit opinion.

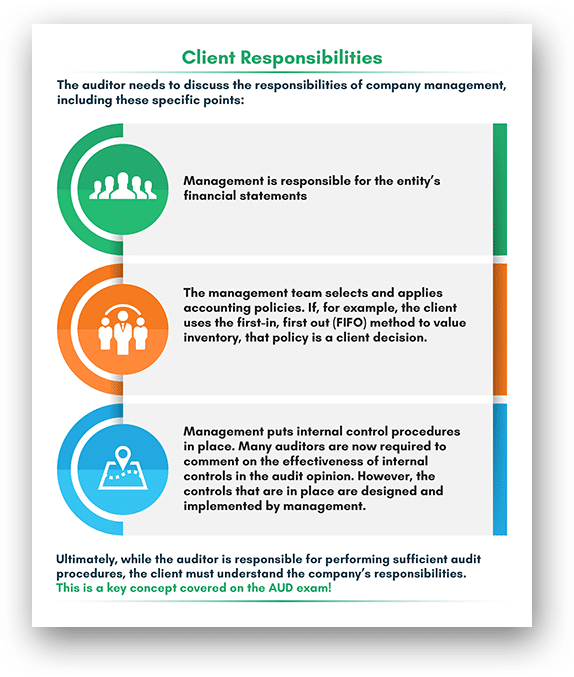

#4- Client responsibilities

#5- Hiring Outside Experts

Auditors may require outside experts to perform specific audit procedures. Hence, working with these professionals requires good communication. Communication is important so that the outside expert understands exactly what they are being asked to do. Here’s a common example:

If a company offers a pension plan to employees, the auditing firm will typically hire an actuary to assess the future liability for pension payments. Furthermore, the actuary hired by the auditing firm analyzes the client’s assumptions about the liability for future pension payments using advanced math concepts.

Once the auditor locates a qualified actuary, he or she must determine if the expert can effectively function as a member of the audit team. Auditors use audit programs, which list the specific tasks required to collect audit evidence. Therefore, the expert must be willing to use the audit program. This topic will require an extensive discussion and proper auditor communication.

Furthermore, the manager of the audit team must also supervise the work of the outside expert and ensure that the audit program is followed. For example, the audit manager must explain how the expert’s work should be documented in the audit workpapers and provide some training on the process.

Communications Between Predecessor and Successor Auditors

Businesses occasionally change to a new audit firm. Consequently, the communication between the predecessor and successor auditors is important. Hence, to prepare for the AUD test, you need to understand each auditor’s role and the communication required by each party.

#6- Understanding roles

A predecessor auditor is the CPA firm that audited a client’s most recent financial statements, or the company that was engaged to perform the current year’s audit, and didn’t complete the work. The predecessor auditor may have resigned during the audit, or possibly terminated.

The successor auditor, on the other hand, is the company that is considering accepting an engagement. The word “considering” is important, because conversations with the predecessor auditor need to take place before the new auditor accepts the engagement.

In fact, the successor auditor should tell the prospective client that the firm cannot accept the audit engagement until after discussing audit issues with the predecessor auditor.

Here are some required communications for this scenario:

#7- Auditor and client disagreements

The predecessor auditor and the client may have disagreed on accounting issues. Hence, the successor auditor must take these disagreements into consideration.

Disagreements may involve accounting principles, required audit procedures, or a lack of sufficient internal controls. Assume, for example, that the client has a policy to recognize revenue when goods are shipped to customers. Consequently, the client decides to change the policy and recognize revenue when customers are invoiced.

However, if the predecessor auditor believes that the new revenue recognition policy is misleading to financial statement readers, or cannot be justified, the new policy may result in a qualified audit opinion.

Basically, successor auditors must decide for themselves if the client is willing to comply sufficiently with accounting standards. If not, the successor may not accept the engagement.

#8- Access to the predecessor auditor

The client must agree to allow the predecessor auditor to respond to every inquiry from the successor auditor. If the client attempts to limit responses, the successor may consider this action to be a red flag that prevents the firm from accepting the engagement.

#9- Workpaper review

The client must authorize the predecessor firm to provide the audit workpapers to the successor auditor. Furthermore, the successor auditor should review the documentation of audit planning, the assessment of internal controls, the audit evidence collected, and the conclusions reached by the predecessor auditor.

Why Communications Are So Important

The communications explained above help the auditor to clarify the responsibilities of both the client and the audit firm. As you can see, the conversations with the predecessor auditor allow the successor to determine if the new CPA firm should accept the audit engagement.

Use these tips to study for the AUD test and you’ll drastically increase your chances of a high CPA exam score!

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

Auditor Independence

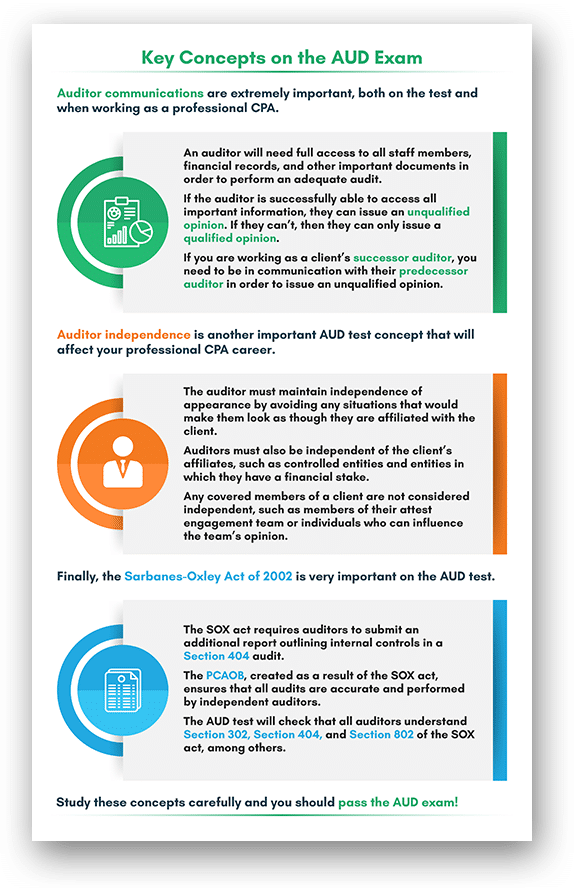

In addition to communication, the AUD test includes a number of questions regarding a CPA’s independence for audit clients and other CPA engagements.

The AICPA has a fantastic resource that explains the AICPA Code of Professional Conduct independence rules in plain English. Therefore, this document is the reference for this discussion.

Use these tips to understand the definition of independence, affiliates, covered members, and covered persons. Yes, they will all be on the final exam!

Defining Independence

For many years, the auditing profession has required that auditors must be independent in both fact (state of mind) and in appearance.

Hence, the definition of independence in relation to this requirement has several components covered on the AUD test:

Using judgment

The auditor cannot be affected by influences that may compromise the CPA’s professional judgment. Accounting requires judgment, and auditors must make judgments during an audit.

Here’s an example to illustrate this point:

In order to perform test work, for example, a CPA defines materiality to be $10,000. Audit exceptions that are more than $10,000 must be investigated, and the dollar amount of materiality impacts the amount of audit work performed.

Thus, auditors must be able to make judgments without having their independence compromised.

Independence in appearance

Independence in appearance means that the CPA must avoid circumstances that would cause a reasonable and informed third party to conclude that the auditor’s independence is compromised. Ultimately, the CPA must retain objectivity while performing the audit.

Threats are not absolute

On the other hand, threats to independence are not absolute. Furthermore, a CPA may be able to remain independent and conduct the audit when some level of influence exists. Essentially, the goal is to keep threats to independence at a minimal level.

Assume, for example, that a CPA is auditing a large national bank, and the auditor has a bank account with the client that carries a $500 balance. Maintaining a small bank balance means that the client bank has some influence, but not enough to impact the auditor’s independence.

Understanding Attest Clients and Affiliates

The AICPA refers to an audit as an attest engagement. However, an attest client includes any entity whose financial statements are audited, reviewed, or compiled (when the member’s compilation report does not disclose a lack of independence).

Additionally, CPAs must also remain independent of affiliates of any attest clients.

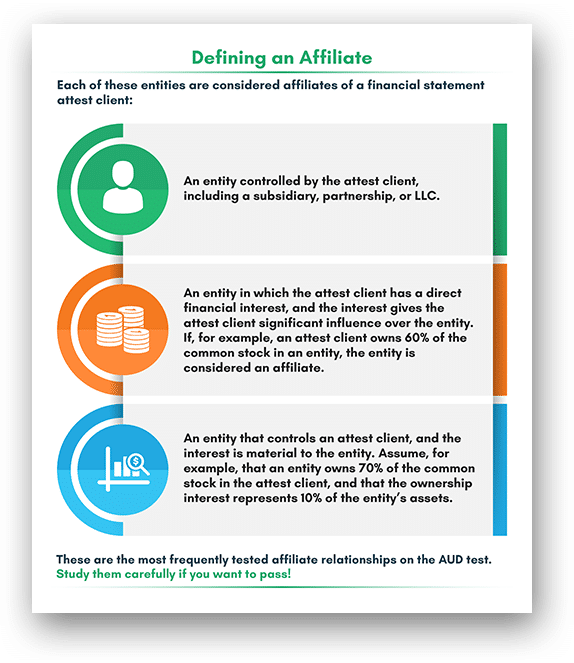

Defining an Affiliate

How Covered Members Impact Independence

Covered members are subject to the independence rules in the AICPA Code of Professional Conduct. Here are several groups of people who are defined as covered members whose relationships are frequently tested on the AUD test:

- CPAs working on the client’s attest engagement team

- A personal in a position to influence the client’s attest engagement team

- A partner or manager who provides more than 10 hours of nonattest services to the client

The Securities and Exchange Commission (SEC) uses the term “covered persons” to define firms and employees who are subject to SEC independence rules.

A Covered Person

The definition of covered persons is almost identical to the covered member term. However, there is one exception involving the classification of consultants.

The SEC labels consultants to be members of the attest engagement team, while the AICPA defines consultants as people in a position to influence the engagement. This distinction is important, so don’t get it confused!

Other Situations when Covered Person Rules Apply

The AUD test covers several unique situations that impair independence, even though the individuals involved are not covered members.

If someone is a director, officer, or employee of a client, that individual is not independent. Furthermore, a person who owns more than five percent of the attest client’s outstanding equity securities is not independent, based on the AICPA Code.

Ultimately, these rules should make logical sense because these parties have a financial interest in the firm. Consequently, the result of the attest engagement will impact the firm.

Becoming a covered member

In many instances, companies hire accountants from the CPA firms that perform attest engagements. This approach makes sense because CPAs working on the firm’s audit have a great base of knowledge about the company. Additionally, these accountants can become productive employees quickly.

The reverse is also true, since an executive with years of accounting experience in a particular industry may leave private industry and work for a CPA firm. Consequently, the Code includes a set of tasks that a CPA must perform to become a covered member:

- Dispose of direct financial interests or material indirect financial interests in the attest client

- Repay any loans to the attest client

- Stop participating in all employee benefit plans offered by the attest client. The investment balance can be transferred to a money manager that is not affiliated with the attest client

Assume for example that a CPA firm hires the former CFO of Acme Manufacturing to manage audit engagements for manufacturing firms. As a result, the former CFO must go through the process explained above to become a covered member for the Acme Manufacturing audit.

Dealing with Family Members

Many AUD questions on independence cover family members. Therefore, you should prepare for family-related questions on this test.

Broadly speaking, members of your immediate family (spouses, dependents) must follow the same independence rules that you follow in order to maintain your independence as a CPA.

However, a family member can be employed with an attest client as long the family member doesn’t work in a key position. Furthermore, there are some complex rules about family members investing in employee benefit plans as employees of attest clients. However, these topics are not tested as frequently so they are of less importance to your exam score.

Finally, the AUD test includes questions on close relatives, which the Code defines as siblings, parents, and nondependent children. Close relatives are subject to some restrictions related to employment and financial activities.

Essentially, just as with family members, a close relative cannot be in a key employment position with an attest client. There is an exception, if the services provided to the attest client are only nonattest services.

Use Common Sense

Ultimately, if you’re not sure about an AUD test topic on independence, use common sense to answer the question.

Assume for example that a covered member purchases a mutual fund that owns stock in an attest client. The mutual fund managers decide on the stock purchases, not the covered member. As long as the mutual fund position isn’t huge, it’s not likely that the covered member’s independence is impaired.

Therefore, if you use these tips to answer auditor independence questions, you will pass the AUD test!

Get The Best Discounts On Your CPA Review Course!

Enjoy $1,250 Off Gleim CPA Premium Pro Course

Enjoy $1,141 Off Becker CPA Pro+

The Sarbanes-Oxley Act

Finally, CPA candidates will see a number of AUD test questions regarding the Sarbanes-Oxley Act of 2002 (aka the SOX Act). The SOX Act was passed in response to the Enron accounting and auditing scandal. Hence, this legislation increases responsibilities for both auditors and company management.

Use this discussion to understand the purpose of the SOX Act and requirements that are covered on the AUD test.

The Purpose of the SOX Act

Congress passed the Sarbanes-Oxley Act after the Enron collapse in the early 2000s. Consequently, after a lengthy investigation, government officials concluded that a lack of internal controls allowed Enron to produce fraudulent financial statements.

Furthermore, regulators also determined that Arthur Andersen, the firm’s auditor, was not truly independent of the company under audit. Additionally, they determined that the audit partners did not perform sufficient audit work on Enron’s financial statements.

There were other public companies that issued misleading and possibly fraudulent financial statements during the same period of time, including Worldcom.

Hence, the SOX Act is an attempt to hold both auditors and company management more responsible for the financial statements. To do so, the Act includes criminal penalties for violating securities laws.

What the SOX Act Requires

Broadly speaking, the SOX Act requires the financial reports to include an additional report on internal controls. Additionally, it attests that the focus of internal controls is to generate more accurate financial data and prevent financial manipulation of the data.

Furthermore, the legislation also requires a Section 404 audit. This means that an independent SOX auditor reviews the firm’s internal controls and policies related to SOX compliance.

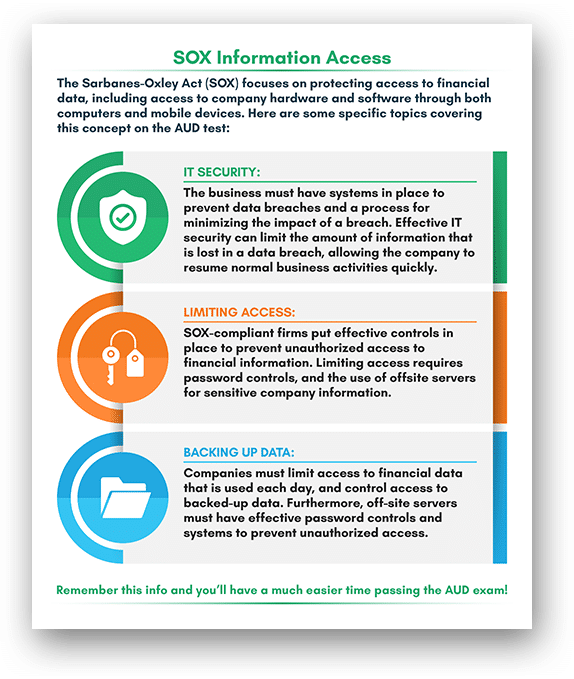

Information access

Essentially, business expansion and employee turnover require an IT department to make constant changes to financial data access. Also, and SOX requires businesses to closely monitor changes to access. Adding or removing employee access increases the risk of a data breach, so the process must be supervised carefully.

The Purpose of the PCAOB

The SOX Act also created the Public Company Accounting Oversight Board (PCAOB). This nonprofit corporation oversees the audits of public companies so that audit reports are accurate and performed by independent accounting firms. Basically, public companies issue securities (stocks and bonds) to the investors. Therefore, these issues must comply with the reporting requirements of the Securities and Exchange Commission (SEC).

The Securities and Exchange Act of ’33 was created to improve disclosure when companies issue securities to the public. Hence, the Securities and Exchange Act of ’34 was passed to protect investors who trade securities after they are issued. The SOX Act made changes to improve financial disclosure and enhance investor protections.

PCAOB has the legal authority to process, review, and approve the registration of public accounting firms that perform audits. Furthermore, the Board also established auditing, quality control, and independence standards for audits of issuers.

The AUD test has a number of questions regarding PCAOB. Consequently, you should take the time to make sure you really understand its function and purpose!

Corporate responsibility for financial reports

Section 302 of the SOX Act puts a great deal of responsibility on corporate financial officers.

Senior officers, according to SOX, “are directly responsible for the accuracy, documentation and submission of all financial reports as well as the internal control structure to the SEC.”

Consequently, these managers now must sign a document stating they have read through each SEC filing and that the report does not contain any untrue statements of a material fact or omit a material fact. Additionally, officers who know of material errors and sign the form are subject to criminal penalties.

This scenario is included on every AUD test!

Internal control requirements

As discussed earlier, Section 404 requires that company management design and implement stronger internal controls. This is in order to generate accurate financial statements and to prevent data theft. Therefore, independent auditors are required to assess the effectiveness of internal controls and to document the assessment.

Recordkeeping rules

Section 802 addresses recordkeeping requirements, some of which are discussed above. Furthermore, this section covers penalties that will be imposed for falsifying or destroying records, and lists the retention period required for record storage.

These sections of the SOX Act are the most frequently tested on the AUD test.

Common SOX Act Test Topics

Finally, here are some specific test topics related to the SOX act that appear on most AUD tests:

Audit partners leading an audit

Prior to the SOX Act, audit partners did not have firm time limits on how long they could lead an audit of a particular client. Thus, many regulators were concerned that partners were losing objectivity by working on the same audit clients for many years.

Consequently, SOX limits the number of years that a partner can lead an audit to five consecutive years.

Audit committee financial expert

The independent audit firm answers to the audit committee of the board of directors. Hence, the SOX Act now requires that financial experts serve on the audit committee.

A financial expert can work in an industry accountant, controller, CFO, public accountant, or auditor role. Therefore, the AUD test may ask you about the professional background of a financial expert.

Non-audit services

If pre-approval is granted by the audit committee, a public accounting firm can offer tax services to an audit client. In this situation, the auditor’s independence is not impaired.

Ultimately, these topics may be included in multiple questions on your AUD test, so make sure that you understand these concepts.

Useful for Your Career

Understanding the SOX Act requirements can help you move forward in your career, after you pass the CPA exam. If you work for a public company as a CPA, you will have some involvement with SOX compliance. Therefore, understanding the purpose and scope of the SOX Act will help you work productively.

Key Takeaways

I know that this is a lot of information for you to take in. However, all of it is important so you should make a serious effort to memorize it all. Here’s a brief summary of the concepts and terms outlined in this guide that will be on the AUD exam:

Hopefully the information contained here will be a helpful resource while you study for the AUD exam. Good luck on your test!