The Business Environment and Concepts (BEC) test includes many concepts that are covered in an MBA program. Consequently, learning these topics can help you pass BEC and grow in your career. The multiple-choice questions in this CPA exam section focus on key information needed to make informed business decisions. Hence, you can use these tips to pass the BEC test and improve your written communication.

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2025

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Gleim CPA Review Course ◄◄ Most Practice Questions

1. Direct costs vs. indirect costs

When you add up the costs incurred to produce a product or service, you’ll incur direct and indirect costs. If you manufacture baseball gloves, for example, you’ll incur direct material costs for leather. Additionally, you’ll post direct labor costs for workers that operate your machines. These economic concepts are traced to the product because you can determine the exact amount of material used and the direct hours incurred.

Now:

Indirect costs, or overhead costs, cannot be directed traced to the product. Repair and maintenance costs for machines, for example, cannot be traced to each baseball glove. Hence, indirect costs are allocated to products using an activity level.

Labor hours worked and machines hours incurred are common activity levels used to allocate indirect costs. You may allocate repair and maintenance costs for machines using this formula: (total repair and maintenance costs) / (machine hours).

What’s the bottom line?

When you see cost accounting questions on the BEC section of the CPA exam, remember that direct costs are traced to products and that indirect costs are allocated to products.

2. Foreign currency

Currency risk is the risk of loss when a company exchanges one currency for another, and this concept is one of the most difficult topics on the BEC test. Many exam candidates skip the foreign currency questions, but a simple example can help you tackle this concept.

Here’s the deal:

Assume, for example, that General Electric (GE) needs to add capital to a company division in Germany. GE must convert US dollars into Euros at the current exchange rate of $1 US dollar to .7 Euros. If GE moves $1 million US dollars to Germany, the dollars will be exchanged into 700,000 Euros.

The BEC test asks students about a particular currency getting stronger or weaker, when compared with a second currency. Here’s an example of each:

- Stronger dollar: If the dollar strengthens against the Euro, the Euro will buy fewer dollars when a currency exchange is made. Say, for example, that the new exchange rate is $1 US dollar to .85 Euros. $1 million previously converted into 700,000 Euros, and now the same exchange results in 850,000 Euros. The dollar is stronger vs. the Euro.

- Weaker dollar: If the dollar weakens against the Euro, the Euro will buy more dollars when a currency exchange is made. Say, for example, that the new exchange rate is $2 US dollars to .7 Euros. The 700,000 Euros are now worth $2 million dollars, rather than $1 million. The dollar is weaker vs. the Euro.

If you go through this thought process and write down some notes, you can work through foreign currency questions.

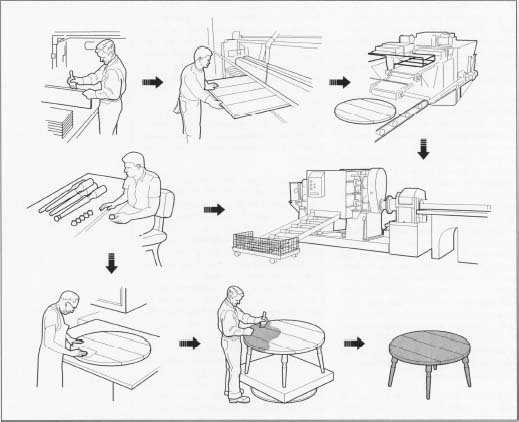

3. Joint costs and separate costs

When encountering this on the BEC exam, it’s logical to think that similar products may go through the same production process, and then separated later in production. If you manufacture wooden tables, for example, you may run each table through the same process of cutting and sanding wood. At some point, the tables are separated, so that they can be shaped, nailed together and painted a specific color.

Joint costs are incurred as more than one product moves through the same production process. At the split-off point, the products are separated and continue through different production processes. Accountants must include both joint and separate costs in the total cost of each product.

4. Liquidity vs. solvency

Liquidity measures a firm’s ability to produce enough current assets to pay current liabilities. When you hear liquidity, think about the company’s checkbook. Here are two calculations used to assess liquidity:

- Working capital: This term is defined as current assets less current liabilities. A business should maintain a positive working capital balance.

- Current ratio: Some owners prefer to look at liquidity using the current ratio of (current assets / current liabilities). Every firm should keep a ratio of at least 1.0 or higher.

Both calculations tell the owner if the company has enough current assets to pay all current liabilities. If not, the business may need to secure short-term financing, such as a line of credit.

The term solvency is different. This is because it refers to a company’s ability to generate enough sales and profits to purchase expensive assets and pay down debt over the long term.

But here’s the kicker:

Financially healthy businesses must address both liquidity and solvency.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

5. Outsourcing

The BEC test covers several qualitative factors that businesses should consider before outsourcing a particular task. These factors are not directly related to finances, although each issue does ultimately impact a firm’s costs and profitability. Assume that you manage a firm that makes wood furniture, and that you are considering outsourcing the production of metal handles for your furniture:

- Quality: If the metal handles do not meet your quality standards, you may have to replace them if they break, and that will damage your relationship with customers.

- Timeliness: An outside supplier must supply the metal handles when you need them in the production process. If the handles are delivered late, or not enough handles are available, you’ll have to stop your production process and risk shipping goods to customers later than scheduled.

- Complexity: Adding outside vendors may complicate your production process. You’ll need to constantly update your vendor on the number of handles you need, and when they must be shipped. Using a vendor requires you to negotiate a purchase price, verify that the vendor shipment matches your purchase order, and pay the vendor on time.

Exam candidates sometimes forget about these important considerations related to outsourcing.

6. Production departments vs. service departments

Not every department in a business produces a product. Some departments, such as legal and accounting, exist to service other departments that are directly involved in producing a product.

Keep in mind that the costs of all departments must be allocated to the product, so service departments costs are allocated to production departments, based on an activity level. If the shipping department incurs 15% of the legal department’s time, for example, 15% of legal costs are allocated to shipping. The shipping department will incur legal, accounting, and other service costs, and these costs are allocated directly to products.

What to know the best part?

This allocation process ensures that every cost is captured and assigned to a product or service.

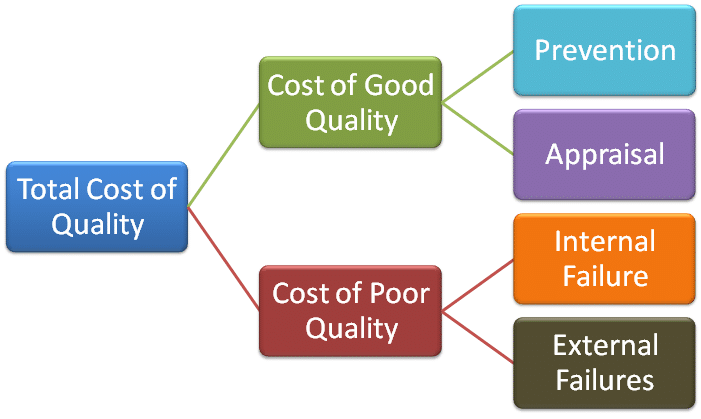

7. Quality costs

The BEC test covers some costs related to product quality, and these costs are incurred to manufacturing a physical product, rather than a service. If, for example, you manufacture hiking boots, you’ll want to minimize these costs:

- Prevention costs: You’ll incur costs to train your staff and your production managers to minimize the risk of producing a defective product.

- Appraisal (inspection) costs: Your firm implements an inspection process, so that defective products are removed from inventory before they are shipped to customers.

- Internal failure costs: If your inspection process finds a pair of defective hiking boots, you’ll incur costs to fix the boots before they can be shipped to a customer.

- External failure costs: If a customer receives a defective pair of boots, you’ll incur costs to get the boots shipped back to your production facility, as well as the cost of repair and shipment back to the customer. An external failure also damages your relationship with the customer, and the customer may not do business with you going forward.

Remember each of these costs if you get a question on product quality.

8. Segregation of duties

Segregation of duties is a frequently tested BEC concept, and every accountant must understand this topic. This concept is the only way to reduce the risk of fraud, particularly fraud committed by workers within a business.

You might be wondering, how can I protect my firm from fraud?

To protect yourself, make sure that you understand the three types of duties that must be segregated among different employees:

- Physical custody of assets: One worker should have physical custody of assets, such as the checkbook, or the keys to the warehouse.

- Authorization: A second person, usually the owner, should have authority to move assets. An authorized check signer, for example, has the ability to move cash by signing a check.

- Recordkeeping: If possible, a third worker should be responsible for posting accounting activity. That would include the task of reconciling the bank accounts, for example.

Ideally, three separate people should handle these duties. The CPA exam asks many questions on this topic, so make sure that you’re clear about segregation of duties.

9. Special orders

Sunk costs (past costs) are ignored when making business decisions, because the cost cannot change. This concept is tested in questions regarding special orders.

Assume that, in the last week of the month, your towel manufacturing business receives a special order to produce 20,000 towels, and that you need to compute the total costs for the order. Your firm pays a $10,000 monthly fee for repair and maintenance costs on machines, and that fee has been paid for with goods produced and sold earlier in the month.

The special order cost should not include any portion of the $10,000 fee, because it is a sunk cost that has already been paid. Sunk costs are not relevant to a special order decision.

10. Times interest earned ratio

The BEC test includes many financial ratios, and one ratio that may seem confusing is times interest earned. The logic here is that a creditor wants to know if you can generate sufficient earnings to make interest payments on debt, and this ratio quantifies the answer:

Times interest earned ratio = (Earnings before interest expense and taxes) / (interest expense on debt)

A business is obligated to pay interest and taxes, so the ratio considers earnings before those expenses are paid. The higher the ratio, the more “cushion” you have in your earnings to make interest payments. A 4:1 ratio is better than 2:1, because you generate more than enough in earnings to pay the interest expense.

Get The Best Discounts On Your CPA Review Course!

Enjoy $1,250 Off Gleim CPA Premium Pro Course

11. Variance analysis

BEC test takers are often confused by favorable and unfavorable variances. For starters, a variance is defined as the difference between a budgeted amount and an actual amount. You may see the terms standard, budgeted, or planned, and all three terms mean the same thing.

Note these differences:

- Cost variances: A favorable cost variance means that actual costs are lower than budgeted, and an unfavorable variance occurs when actual costs are higher than planned.

- Revenue variances: A favorable revenue variance means that actual revenue is higher than budgeted, and an unfavorable variance occurs when actual revenue is lower than planned.

Before you answer a variance question, note whether the question is asking about costs or revenue.

Invest the time

The BEC test is not just an accounting test, because it includes concepts that you’ll use as a business manager. Invest the time required to learn these useful concepts, which can be put to use throughout your business career. Use these tips to succeed on the BEC test.

Need some extra help with passing BEC? Learn more about the best CPA review courses to ensure you pass your first time.