If you’re interested in pursuing a career in accounting, then you’re in luck! I’ve assembled 43 of the most commonly asked questions about CPAs along with detailed answers to each of them.

Take a look below to learn more about the most common questions about Certified Public Accountants!

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2026

- Gleim CPA Review Course ◄◄ Most Practice Questions

- UWorld CPA Prep Course ◄◄ Best Video Lectures

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Lambers CPA Review Course ◄◄ Best Testing Software

What Is A CPA?

An individual who is a Certified Public Accountant (CPA) is an expert in accounting, taxes, and various other business-related areas. It isn’t easy to earn a CPA license. To qualify, you need to:

- Pass all four sections of the Uniform CPA exam. You are eligible to take the CPA exam only if you have completed 150 semester hours of college coursework.

- Acquire professional work experience in public accounting or similar fields. The requirements vary by state.

- Obtain a license to practice as a CPA in one of the 55 jurisdictions in the United States.

That isn’t all. Even after you obtain the CPA credential, you need to comply with the Continuing Professional Education (CPA) requirements for CPAs. This stipulation ensures that CPAs remain abreast of new developments and are always in a position to provide quality professional services to their employers or clients.

What Does CPA Stand For?

CPA is an acronym for Certified Public Accountant. CPAs are licensed by one of the state boards of accountancy. Therefore, a CPA license holder is an individual who has gone through a rigorous education and training process.

Three E’s of CPA

There are three E’s to becoming a CPA: Education, Examination, and Experience. The first E refers to the requirement of having completed 150 semester hours of college education to become eligible to take the CPA exam. The second E is the Uniform CPA exam: acknowledged as one of the most difficult professional certification exams. Finally, the third E refers to the work experience that you need to obtain in order to be eligible for your CPA license.

What Are The Differences Between A CFA And CPA?

Although the Chartered Financial Analyst (CFA) and Certified Public Accountant (CPA) qualifications are both related to finance, there are significant differences between the two. A CFA’s expertise is focused on the investment industry. Consequently, CFAs work as portfolio managers, investment advisors, and research analysts.

A CPA, on the other hand, is a specialist in accounting and taxes. You can find CPAs working in small business accounting, or the finance departments of very large businesses.

CFA vs CPA: which is a better qualification?

A CPA’s knowledge is more broad-based. An individual who holds the CPA license would have expertise in a wide variety of finance-related areas. A CFA is a more specialized course and is targeted at those who want to work in the investment management profession. Compare the details of CPA vs CFA designations.

What Does A CPA Do?

Certified Public Accountants work in a wide range of professions. You can find them in banking, financial services, government jobs, and education. However, most CPAs are employed in public accounting or corporate accounting.

If you choose to work in public accounting, you could join one of the “Big 4” accounting firms – Deloitte, PricewaterhouseCoopers, Ernst & Young, or KPMG. These firms, as well as their smaller counterparts, provide accounting, auditing, tax, and consulting services.

Many CPAs also opt to work in corporations and government entities. Their job could involve managerial or tax accounting, internal auditing, or financial analysis.

Who Needs A CPA?

Certified Public Accountants provide a range of services across different types of organizations.

- Public accounting firms: CPAs are involved in the preparation, review, and auditing of their clients’ financial statements. Their expert knowledge in the fields of accounting, taxes, and related areas helps them to fulfill this role.

- Large corporations: Big companies need the services of CPAs. In these organizations, CPAs work in accounting, internal auditing, and tax accounting. They play a crucial role in preparing the corporation’s financial statements and ensuring that these adhere to the required regulatory norms.

- Small businesses: CPAs can play an important role in small companies as well. They provide financial advice and can help with the firm’s accounting records. Many small businesses use CPAs to assist them with their taxes and to represent them before the IRS.

You can also find CPAs working in government organizations and the educational sector.

Why Become A CPA?

The Certified Public Accountant (CPA) credential is one of the most sought-after professional qualifications that you can acquire. It is highly regarded in the fields of accounting, taxes, and auditing. According to a NASBA article titled “Top 5 Reasons to be a CPA,” CPAs are often viewed as “an elite group of professionals.”

Why is that? Why do CPAs command such a high degree of respect in the accounting profession? One reason is that in order to become a CPA it is necessary to pass the Uniform CPA exam, which has a pass rate that is usually between 50% and 60%. But once you cross this hurdle and acquire your CPA license, you are likely to find employment at a salary that is higher than that of accountants who do not hold this prestigious credential.

A higher-paying job is not the only benefit that a CPA could be entitled to. Your qualification could also put you on the fast track for promotions and provide you with additional job security as well.

How Do You Become A CPA?

Each state board of accountancy specifies the requirements that you need to fulfill to gain the Certified Public Accountant credential. The conditions that you have to meet usually include studying accounting in college, passing the Uniform CPA exam, and working for a specific period in public accounting or a related field.

The most challenging part of the process is to pass the CPA exam. This involves passing each of the four exam sections: Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG).

How Long Does It Take To Become A CPA?

There are three essential requirements for becoming a Certified Public Accountant. The first is that you need to have completed 150 semester hours of college coursework, which provides you with the eligibility to take the Uniform CPA exam.

You may wonder how many CPA exam parts there are. The exam consists of four sections; you are permitted to take all of them together. However, you may also choose to take them one at a time or take two or three in a particular testing window.

A testing window refers to the months when the exam is offered. These are the four testing windows:

- Q1: January 1 – March 10

- Q2: April 1 – June 10

- Q3: July 1 – September 10

- Q4: October 1 – December 10

Ultimately, you are required to pass all four sections within a rolling 18-month period. The credit that you get for any section that you pass will remain valid only for 18 months. Hence, if you miss this deadline, you will have to retake the particular section (or sections) that fall outside the 18-month period.

The final requirement is work experience. This varies by state but usually involves obtaining one or two years of accounting experience.

So, to summarize, you need to gain 150 hours of college coursework, pass the CPA exam, and gain the required work experience specified by your state board of accountancy.

How Much Does It Cost To Be A CPA?

There are five different types of costs involved in getting your CPA license. Here’s a summary:

| Type of cost | Amount range | Estimated total cost |

| CPA exam prep course fees | $1,200 to $3,000 | $3,000 |

| CPA exam application fee payable to your state board of accountancy | $50 – $200 | $125 |

| Examination fees | Approximately $200 for each of the four sections | $800 |

| Registration fees | Approximately $75 for each of the four sections | $300 |

| CPA Ethics Exam fee (not required in all states) | $150 – $200 | $175 |

| Total | $4,400 | |

Can A CPA Practice In Any State?

A CPA license is issued by the board of accountancy in one of the 55 license-granting jurisdictions. These are located in each of the 50 states and Puerto Rico, the District of Columbia, the U.S. Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Islands. A person who holds a CPA license issued by a specific state may or may not be allowed to provide services in another.

Here’s how you can check if a CPA license holder can practice in a state other than his or her home state:

Go to CPAmobility.org and enter your principal place of business and the jurisdiction in which you plan to perform services. You also need to enter the type of service that you expect to provide. Upon submitting this information, the website will tell you whether you can practice in the location that you have indicated.

What Is The CPA Exam?

The CPA exam consists of four sections, each of which is held over four hours. The four sections are Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG).

Is The CPA Exam Worth It?

It is one of the toughest professional exams. Consequently, you may study for months and fail to get a passing score. However, if you “study smart,” it is entirely possible for an average candidate to pass. For that reason, and for the multiple benefits it can have on your career mobility and salary, it is definitely worth it to take the exam.

Compare the Best CPA Review Courses

Who Can Take The CPA Exam?

Eligibility to take the CPA exam varies by state. However, most states have similar requirements. You commonly need to be a U.S. citizen (although certain states do permit non-U.S. citizens to take the exam), be 18 years of age, and have completed 150 semester hours of college coursework.

What Are The CPA Exam Education Requirements?

CPA exam education requirements differ by state. You can check with your local Board of Accountancy regarding your state’s rules, but most jurisdictions follow the 150-hour rule. This stipulates that you need to obtain 150 semester hours of education from an accredited university. There are also rules regarding the subjects that you have to study, with most states requiring you to complete a specific number of semester units in accounting.

Can I Take The CPA Exam Without An Accounting Degree?

Most states stipulate that you need to hold an accounting degree to take the CPA exam. However, it is possible for you to take the CPA exam in certain locations if you don’t hold an accounting degree. States like Alaska, Maine, Massachusetts, Georgia, and Hawaii allow candidates to take the CPA exam without this degree.

But there’s a catch: These states still require you to complete a specific number of semester hours in accounting.

How Hard Is The CPA Exam?

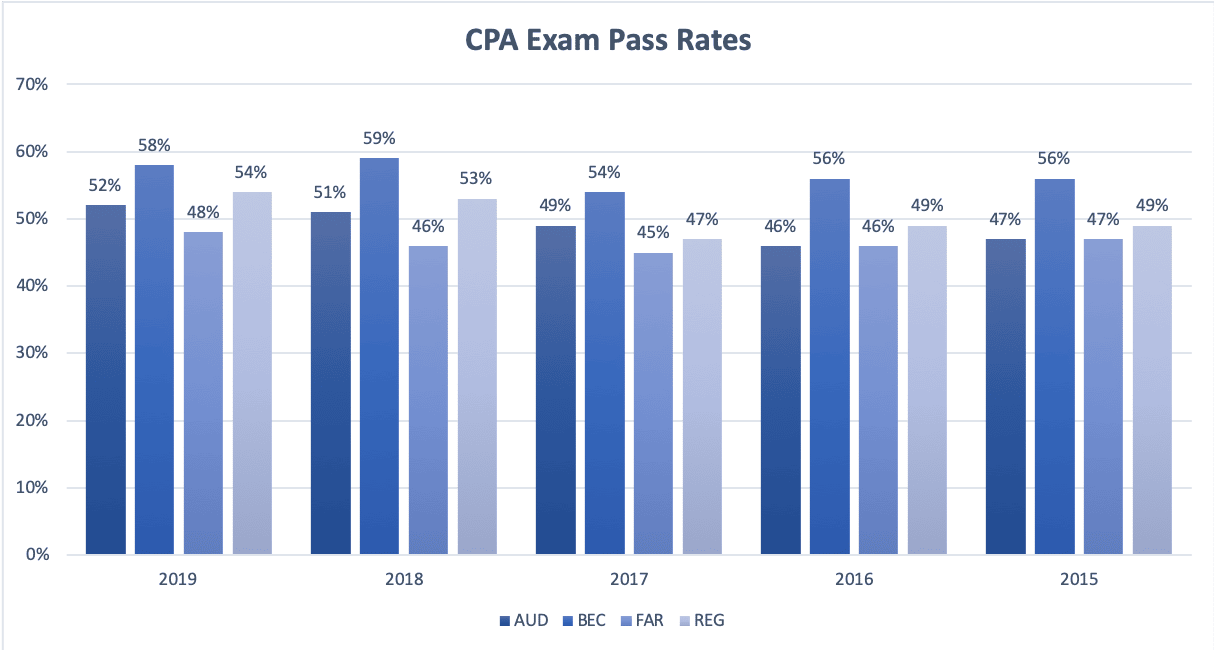

The CPA exam is one of the most difficult professional exams. The pass rates are usually about 50%.

Here are the pass percentages for 2015-2019:

2015-2019 Pass Rates

Source – AICPA

Is The CPA Exam Hard To Pass?

It is, but that doesn’t mean you can’t score the required 75 in each section. A focused approach, dedication, and a good CPA review course should help you obtain a passing score.

Why Is The CPA Exam So Hard?

When you are starting out in your accounting career, you may ask yourself “What is the CPA exam like? Will I be able to pass?”

It’s an unavoidable fact that the CPA exam is difficult. About half the candidates who take the exam fail to score 75, the minimum required to pass each of the four sections. The American Institute of Certified Public Accountants, who prepares the exam, wants to ensure that successful candidates have the expertise and knowledge to fulfill their professional commitments.

So, while it may be true that the exam is hard, you shouldn’t have anything to worry about if you are adequately prepared.

Is The CPA Exam Harder Than The BAR Exam?

Both the CPA exam and the BAR exam are difficult in their own way. The common factor is that you need to study a vast amount of material if you want to gain the CPA credential or become a lawyer. When it is time to take the exam, you should be able to remember all that you have learned and have the ability to answer the questions that are put to you.

Is CPA harder than BAR? The jury is still out on that, but remember that the CPA exam is more about committing vast amounts of knowledge to memory and remembering different processes and formulas. The BAR exam, on the other hand, focuses on your writing skills. It requires you to explain the reasoning that you have adopted in your answers.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

Where Can I Take The CPA Exam?

The CPA exam is administered at Prometric test centers in coordination with the National Association of State Boards of Accountancy (NASBA). There are multiple Prometric centers in each state, but not all exams are offered at every center.

So how can you find out where to take the CPA exam? Go to Prometric’s webpage and enter your details. You will need to provide your state, the exam that you propose to take, and your address. The website will give you the addresses of the test centers to choose from.

Can I Take The CPA Exam In A Different State?

Yes, you can! AICPA’s rules permit you to select your CPA exam location from any of the 50 states or the District of Columbia, Puerto Rico, Guam, and the U.S. Virgin Islands. This means that if you don’t have an accounting degree but still meet the soft semester requirements, you can take the exam in a state that doesn’t require the degree.

How Do I Schedule The CPA Exam?

It’s simple to know how to schedule the CPA exam. Just go to www.prometric.com/CPA and provide the required details. However, you must remember that you need a valid Notice to Schedule (NTS). NASBA will issue you an NTS after it determines that you are eligible to take the exam.

How Is The CPA Exam Graded?

There are four sections that make up the CPA exam. In each section you can get a score that ranges from 0 to 99. The minimum score required to pass is 75. Hence, that’s the score that you must get in each section.

The candidates who ask themselves the question “How is the CPA exam scored?” often mistakenly assume that they are awarded a raw score. (A raw score is the number of questions that you get correct. So, if there were 20 questions and you get 15 right, your raw score would be 15). Remember that in the CPA exam, the score does not refer to a raw score.

In fact, your score is based on whether you got the answer right or not as well as the difficulty of the question.

How Long Is The CPA Exam?

The CPA exam consists of four sections of four hours each.

The exam is held four times a year. You are allowed to take the exam section by section or you can take all four sections in the same quarter. Many candidates want to know how to pass the CPA exam fast. Ultimately, the best approach is to prepare well with the help of a good CPA review course.

How Many Parts Are In The CPA Exam?

One of the first things that candidates want to know is “What does the CPA exam consist of?” There are four parts to the CPA exam known as sections. The four sections are:

- Auditing and Attestation (AUD)

- Business Environment and Concepts (BEC)

- Financial Accounting and Reporting (FAR)

- Regulation (REG)

How Many Questions Are On The CPA Exam?

The CPA exam has a total of 307 questions. Here is the number of questions in each section:

| CPA Exam Section | Number of multiple-choice questions | Number of task-based simulation questions | Number of written communication questions | Total number of questions |

| Auditing and Attestation (AUD) | 72 | 8 | – | 80 |

| Business Environment and Concepts (BEC) | 62 | 4 | 3 | 69 |

| Financial Accounting and Reporting (FAR) | 66 | 8 | – | 74 |

| Regulation (REG) | 76 | 8 | – | 84 |

| Total | 276 | 28 | 3 | 307 |

When Can I Take The CPA Exam?

The CPA exam is held in four “testing windows.” These are the dates when the exam is offered:

- Q1: January 1 – March 10

- Q2: April 1 – June 10

- Q3: July 1 – September 10

- Q4: October 1 – December 10

Your decision regarding when to take the CPA exam should be based on your level of preparation. If you are confident that you can pass, you should take the exam as early as possible. Remember: you have a rolling 18-month period in which to pass all four sections.

What Do I Bring To The CPA Exam?

You must carry the following with you for the CPA exam:

- Your Notice To Schedule (NTS)

- Two forms of identification

If you don’t have these documents, you may not be allowed to take the exam.

That’s all that you need, but you are free to bring additional materials if you want. However, there are also certain items that are prohibited: calculators, personal digital assistants, and other computer devices.

How Many Times Can I Take The CPA Exam?

There is no limit to the number of times that you can take the CPA exam. However, you need to pass all four sections within an 18-month rolling window. If you don’t, then the pass credit for the section that falls outside of the 18-month period will lapse. Consequently, you will have to retake that section.

What Is The Hardest Part Of The CPA Exam?

If you consider the pass rates for the four sections of the CPA exam, FAR is the most difficult. The cumulative pass rate in the first three quarters of 2018 for the Financial Accounting and Reporting section was 46.79%. Comparatively, the other three sections have a higher pass percentage.

But you can’t say which CPA exam is the hardest based only on the pass rate. You may be familiar with the topics covered in FAR and could find it to be the easiest section. Therefore, the most difficult section is the one that you haven’t prepared for adequately.

What Is The Easiest Part Of The Exam?

In the first three quarters of 2018, BEC had the highest cumulative pass percentage at 59.07%. The pass rate for FAR was 46.79%. AUD (51.76%) and REG (54.46%) also had lower pass rates.

But does that make the Business Environment and Concepts section the easiest part of the CPA exam? In fact, it doesn’t. The easiest section is the one that you are best prepared for.

Get The Best Discounts On Your CPA Review Course!

Take $1,600 Off UWorld CPA Elite-Unlimited Course

Extended Sale – $1,346 Off Becker CPA Pro+

Extended Sale – $1,345 Off Becker CPA Pro

How Long Should I Study For The CPA Exam?

According to conventional wisdom, you need to spend about 300 hours preparing for each of the four sections of the CPA exam. However, that’s only an approximate period. Some candidates may require more time; others could complete the study material much faster. Hence, your focus should be on making the most of the time that is available to you.

What Are The Best Study Guides For The CPA Exam?

There are several excellent study guides that you can buy for the CPA exam. These include, in no particular order:

- Roger CPA Review Course

- Surgent CPA Prep Course

- Becker CPA Review Courses

- Crush The CPA Exam Study Guide

The best CPA study guides are those that meet your specific needs. Therefore, it’s advisable to weigh the pros and cons of each before you make a choice.

Which Part Of The CPA Exam Should I Take First?

It can be hard to decide which CPA exam to take first. Some people say that you should start with the section that you find hardest. This will allow you to get it out of the way. Subsequently, you can sail through the remaining three sections.

But this may not be the right approach. It’s almost like setting yourself up to fail! It may be better to tackle your strongest section first. Passing the first part of the CPA exam can give you the confidence and motivation that you need to study for the remaining three sections.

Compare the Best CPA Review Courses

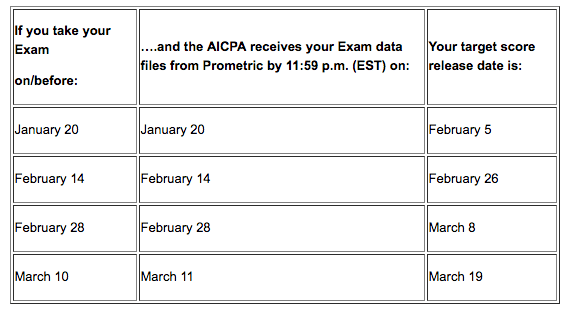

When Are The CPA Exam Scores Released?

Exam scores are announced according to a predetermined schedule of CPA exam score release dates communicated by the AICPA. Candidates who want to know what time are CPA scores released can refer to the AICPA website.

For example, here are the score release dates for Q1 2019:

Testing window: January 1 – March 10

Source – AICPA

How Do I Check My CPA Exam Score?

If you want to know how to check your CPA exam score, go to your State Board of Accountancy website and login to see your CPA exam scores.

Who Grades The CPA Exam?

The CPA exam is graded by the American Institute of Certified Public Accountants, also known as the AICPA.

Who Issues A CPA License?

A CPA license is issued by one of the 55 State Boards of Accountancy. You can find a list of the boards on NASBA’s website.

Are CPA Exam Fees Tax Deductible?

No, CPA exam fees are not a tax-deductible expense. The IRS rules do not allow you to claim exam fees as a tax deduction.

Which CPA Prep Course Is The Best?

Choosing a CPA review course can be difficult. There is a wide range of options available, and having to select one can leave you confused. So, should you buy the Becker CPA program, which happens to be the most expensive? Or should you go for a mid-priced program, like UWorld CPA Review?

The best approach is to test the CPA Review Courses before you buy. Most offer a free trial: take advantage of this and pick a course that you are comfortable with.

What Is The Average Salary For A CPA?

According to the Journal of Accountancy, a new CPA with about a year of experience can expect to earn an annual salary of $66,000. Furthermore, CPAs who have been working for longer can make substantially more. Human resource consulting firm Robert Half International points out in its Accounting and Finance Salary Guide 2019 that the Chief Financial Officer of a corporation can expect to earn between $121,250 and $497,250 per year.

Does A CPA License Expire?

CPA licenses are issued by state boards of accountancy and are issued for a limited period. For example, the license issued by the California Board of Accountancy is valid for two years. You can get your license renewed by approaching your state board and complying with its requirements.

Candidates often also ask the question “Do CPA exam scores expire?” You have to pass all four sections of the CPA exam within a rolling 18-month period. Consequently, if you pass a section and 18 months pass without passing the other three sections, you would need to take the exam for the first section once again.

What Are The Highest Paying CPA Jobs?

The best paying CPA jobs are found in corporate accounting, financial services, and public accounting. An internal auditor with one to three years experience could expect to earn as much as $100,000 annually in a bank. Alternatively, a manager in a public accounting firm could command a yearly package of $150,000. The chief financial officer of a large corporation could earn half a million dollars or more.

What Are The Best Jobs For CPAs?

CPAs have several options when choosing an accounting career. They can opt to work in:

- Public accounting

- Financial services

- Corporate accounting

- Government jobs

Each of these areas presents attractive opportunities for CPAs. However, the “best” or most satisfying CPA jobs will depend on the specific person. There’s an excellent article published by the AICPA that goes into this topic in greater detail.

Can I Be Self-Employed As A CPA?

Yes, you can be a self-employed CPA! If you choose to work for yourself, you could provide bookkeeping and tax filing services to small businesses. CPAs can also work as consultants. However, it is advisable to gain some work experience before starting on your own.

Hopefully some of your burning questions have been answered! If you have any more questions about CPAs, feel free to leave them in the comments below; my team and I are happy to answer them!