The state board of accountancy issues CPA licenses. These are valid within the state but may not be recognized in other jurisdictions.

This implies that while the CPA license that you hold could allow you to provide various services within your home state, you could face a situation where your license would not give you the authority to perform the same services in another state.

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2025

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Gleim CPA Review Course ◄◄ Most Practice Questions

Your CPA license could be invalid in another state

In some circumstances, an out-of-state CPA could be barred from providing specific services while being allowed to provide others.

It can all get very complicated considering that there are 55 different jurisdictions; each of which have their own set of rules. Can an individual who holds a CPA license in, say, California, provide audit or tax services in New York? Is a CPA licensed in Guam allowed to work in Florida?

At times, the situation can be even more confusing because the rules that apply to individuals differ from the rules for firms.

Before we attempt to address the issue of transferring your CPA license from one state to another, it is essential to understand the meaning of a few terms.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

Transferring your CPA license – the basics

What are the steps that you should follow if you want to work or provide services in a state other than the one that has issued your license? The good news is that as a general rule, the transfer of a CPA license is permissible. However, this is not true in every situation.

Let us address this point in some depth. As a first step, let’s familiarize ourselves with some relevant terms:

Mobility

This term refers to your ability to be allowed to practice in a state other than your home state without the need to obtain an additional license.

Both the American Institute of CPAs (AICPA) and the National Association of State Boards of Accountancy (NASBA) are in favor of permitting licensed CPAs to practice across state lines and international boundaries. Towards this end, AICPA and NASBA have developed the Uniform Accountancy Act (UAA).

The UAA is a model licensing law that seeks to provide a uniform approach for the accountancy profession in the U.S. and practice mobility for CPAs is one of the key issues that it addresses.

Why is it important for the different state boards of accountancy to adopt a standard approach to mobility? Keep reading:

Remember that there are 55 different jurisdictions – the 50 U.S. states, Puerto Rico, the District of Columbia, the U.S. Virgin Islands, Guam, and the Commonwealth of the Northern Mariana Islands. If a CPA license holder were to be responsible for obtaining prior approval before beginning work in a particular state, the process could be cumbersome and lead to unnecessary delays.

According to the AICPA’s website, 52 of the 55 jurisdictions have already passed mobility laws and are now in the process of implementing them. This makes mobility an easy and smooth process in most situations.

Individual mobility and firm mobility

There is a crucial difference between these two terms. Individual mobility allows you to provide non-attest services, like tax services or consulting, in a state other than your home state. Firm mobility refers to attest services like review, examination, and audit.

Different rules govern these two types of mobility. Most states permit individual mobility; however, only about half the states in the U.S. allow firm mobility. But this number is expected to go up in the years ahead.

Substantial Equivalency

This concept provides the basis on which a CPA is allowed to practice in another state. According to the principle of Substantial Equivalency, jurisdictions that follow the same set of rules in granting CPA licenses could allow license holders in one state to practice in another.

Most states have common licensing requirements. These are:

- 150 semester hours of formal education

- A minimum of one year of experience

- Successful completion of the Uniform CPA exam

These are referred to as the 3E requirements: Education, Experience, and the CPA Examination.

If an individual has met these requirements and has obtained a CPA license in a particular state, the concept of Substantial Equivalency could allow the CPA license holder to practice in another jurisdiction.

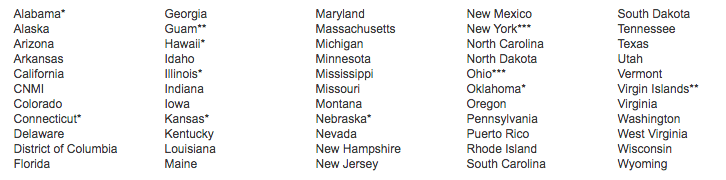

The National Qualification Appraisal Service, which is a unit of NASBA, has found that the following states have CPA licensure requirements that are substantially equivalent.

(Source: NASBA)

NASBA points out that Alabama, Connecticut, Hawaii, Illinois, Kansas, Nebraska, and Oklahoma follow a two-tier system. At the first stage, a certificate is issued that does not give full privileges to the CPA. A license is typically issued, subject to certain other requirements being met. An individual’s credentials would be considered to be “substantially equivalent” only after the state board has granted a license.

Guam, New York, Ohio, and the Virgin Islands follow rules that differ to some extent from the other states.

No notice, no fee, no escape

This principle, which finds a place in the Uniform Accountancy Act, explains the meaning of mobility for CPAs. When a CPA license holder travels to a new state for work, this rule applies.

The no notice, no feel no escape rule means:

- There is no need to provide a notice to the state board of accountancy where the CPA license holder proposes to work.

- No fees are payable to the state’s board. However, in the case of firms, certain fees may be payable.

- The CPA license holder consents to the state board’s jurisdiction and is required to follow the rules that are applicable in the state where the work is being carried out. This is the no escape rule.

Get The Best Discounts On Your CPA Review Course!

Enjoy $1,250 Off Gleim CPA Premium Pro Course

Compare the Best CPA Review Courses

Here’s how you can check if you can transfer your license

NASBA and AICPA have developed a useful tool that makes the task of ascertaining if it is possible to transfer your CPA license very easy. This tool is available at CPAmobility.org.

All that you have to do to use this tool is to go to the website and:

- Enter your principal place of business – this is the state or jurisdiction that has issued your CPA license.

- Next, you are required to enter the state in which you propose to work. Remember that the work that you do could be by mail, telephone, or by electronic means.

- Finally, you need to select the type of service that you will be performing. Your choices are:

- Audit or other engagement following Standards on Auditing (SAS)

- Engagement following Public Company Accounting Oversight Board (PCAOB) standards

- Examination of prospective financial information following Statement on Standards for Attestation Engagements (SSAE)

- Review of financial statements following Statements on Standards for Accounting and Review Services (SSARSs)

- Services not listed above

- Tax Services, including tax returns

After you provide this information, you need to hit the SUBMIT button. The tool will immediately throw up a result for “individual requirement” as well as for “firm requirement.”

Remember that if you want to work in an out-of-state location, it is essential that you should hold a valid CPA license in your home state.

CPA mobility is increasing

It is becoming easier to transfer your CPA license from one state to another. This is especially true for individual mobility, but even firm mobility is making rapid strides.

As there are 55 jurisdictions, checking if your license and credentials are valid in a different state can be a complicated task. The best approach is to use CPAmobility.org, the mobility tool developed by NASBA and AICPA. If this does not help, it is a good idea to contact the accountancy board in the state in which you plan to work for additional information.