Every small business needs a reliable and robust accounting system. Accurate and timely accounting records can give your company a significant advantage. Furthermore, access to your financial data could allow you to monitor your expenses, track your sales, and identify growth opportunities.

However, many entrepreneurs don’t appreciate the benefits that error-free and regularly updated accounting records can provide. In their opinion, the drudgery of accounting is something that they must tolerate. Hence, many of them are reluctant to learn the basics and leave the work to their accountant or to a professional who is retained on a temporary basis.

There are two big problems with this line of thinking: you can miss out on saving money and put yourself in legal jeopardy!

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2025

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Gleim CPA Review Course ◄◄ Most Practice Questions

Are You Satisfied With Your Existing Accounting System?

A Small Business Action Plan to Get Your Accounting Right

Right now, you’re probably wondering: what exactly can I do as a small business owner to come to grips with my accounting system and records? Do I need to go back to school? Will all this be on the test?

Don’t worry! Let’s identify the specific steps that you can take to correct course:

Manage your cash

Never forget this: cash is king.

It is the lifeblood of your business. You need money to buy inventory and raw materials and in order to meet your other expenses. Furthermore, how will you pay your employees if you don’t have enough cash?

In order to stay on top of your business, you must check your cash position every day. Although this responsibility can be handled by your accountant, you should be involved as well. Remember that having sufficient cash isn’t the same as being profitable; your income statement could show a healthy profit, but you may face a cash shortage if your money is stuck in slow-moving inventory or receivables.

Make it a practice to review your projected cash flow every week. This will help you to keep track of your liquidity and could give you the time you need to arrange for extra money if necessary.

Learn More About The CPA Exam

Track your vendor payments

Many small businesses make purchases on credit. If you follow this practice, it is essential to keep your commitments and pay your vendors on time. Try and negotiate a 60-day or 90-day credit period; if your supplier is willing to wait for two or three months for payment, it can improve your liquidity and help lower your borrowing costs.

The “accounts payable” in your balance sheet tells you the total sum that you owe your vendors on the balance sheet date. Your accounts payable system should be able to provide you with a list the payments that are due to various vendors and the payment deadlines.

One precaution that you must take is to carefully keep track of the invoices you have paid. They should be filed in an organized manner so that you can retrieve a specific invoice if it is required.

Accurately record your transactions

As a rule of thumb, an entry should be made in your books for every transaction. Hence, each sale and every purchase should be recorded within a pre-decided timeframe.

Some business owners put off this essential work for as long as possible, storing all their receipts and invoices in a desk drawer and promptly forgetting about them. If you’re like this, and your process of making entries starts only when tax filing season approaches, you are making the entire situation much more stressful than it needs to be!

Maintain your records in an organized manner and ensure that you store all your receipts, invoices, and other documents carefully. If an accountant is responsible for this task, it’s a good idea to supervise the work yourself. After all, if documents are filed in a haphazard manner you could spend hours looking for the paper or receipt that you are trying to locate. Non-availability of vital records could even result in a lower tax deduction, making you pay more money for no good reason!

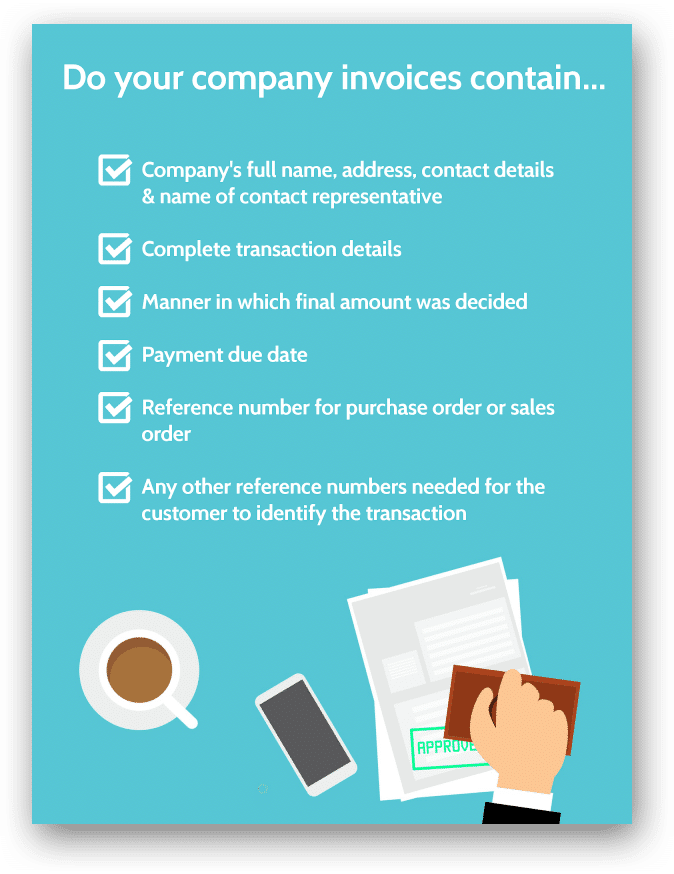

Streamline your invoicing

It’s essential that each invoice you send to your customers is accurate and contains all the necessary information. Make sure your company’s invoices all include the following details:

Bonus tip: This is also a good stage for you to decide if you want to offer a cash discount on your invoices. “2/10, Net 30” could be a good way of improving your liquidity. This term refers to the trade credit provided to a customer under the terms of which a discount of 2% is given if payment is made within ten days. Alternatively, if the customer pays between day 11 and 30, the full amount is payable.

Manage receivables

If you sell on credit, it’s critical to keep an eye on your receivables. If a customer doesn’t pay by the due date, it’s important to send a reminder and ask for your payment.

Your accounting system should be able to give you an accounts receivable aging report. You can use this to call or email the clients who have missed their payment date. Furthermore, if an account becomes uncollectible, you have to write off the amount to get a tax deduction.

Seriously, it’s very important to monitor this aspect of your business closely. If your “days sales outstanding” shows a rising trend, it’s definitely time to take corrective action. You may need to review your credit policy and offer credit only to those customers who have a good payment record in order to get out of this hole!

Manage inventory

If your business maintains an inventory of the products that you sell, you must have:

- The right products

- An adequate quantity of stock

- The ability to make the stock available at the right time

How will you ensure that you meet these requirements at all times? You can keep track of your inventory manually or, if your business is large enough, you can use inventory management software. Remember: it’s crucial to periodically audit your stock and match your physical inventory with your accounting records.

Understand depreciation of long-term assets

Many of the assets that you use in your business decrease in value over time. This decrease is referred to as depreciation, and in specific instances, it could provide you with a tax advantage.

The IRS permits you to depreciate assets that meet the following criteria:

- You must own the asset.

- It must be used in your business.

- The asset or property should have a “determinable useful life.”

- It should last more than one year.

Assets like computers, vehicles, and furniture can be depreciated. The sum that you write off as depreciation serves to reduce your net income and consequently lowers your tax liability. You can claim depreciation by filing IRS Form 4562.

Additionally, you can depreciate an asset over its useful life as determined by the rules made by the IRS. According to these rules, the cost that you have incurred in acquiring vehicles, computers, and office equipment can be written off over three years. Office furniture and fixtures have a useful life of seven years.

You should also know that you can depreciate tangible assets as well as intangible assets. While the former include computers and vehicles, some examples of the latter are patents and copyrights.

Pay employees while following the rules

As an employer, it’s your responsibility to withhold various amounts from payments to salaried employees, as well as from those who are on hourly wages. These amounts are typically for federal and state income tax, social security, and Medicare. It can get pretty complicated, so you may want to use the services of a payroll service provider to make sure you get this right.

Bear in mind that you are required to deposit the amounts that you deduct within the stipulated deadlines. You can get more information about federal, state, and local payroll taxes here. Additionally, you can use this free paycheck calculator to arrive at the sums that you are required to withhold.

Review profit and loss

Your profit and loss statement can provide a wealth of information about your company’s performance. It’s a good practice to conduct a review every month, but you may also benefit from carrying out a more detailed study every quarter.

What should you look for? One thing you can compare is your current year’s performance according to your budget. If your sales are lower than expected, you may want to take corrective action. Ask yourself: would lowering prices help you to increase revenues? You may also want to compare your current year’s numbers with the same period in the previous year.

A good accounting system will allow you to drill down and analyze your different expenses. Therefore, the insights this exercise provides could help you to improve your profitability and make more money!

Review balance sheets

Your balance sheet provides a snapshot of your assets and liabilities on a specific date. The balance sheet formula explains the source and application of funds like so:

Assets = Liabilities + Shareholders’ Equity

When you carry out a review, keep an eye out for the changes that have taken place between the latest statement and the statement made on an earlier date. What can this review tell you?

Consider an example where you see that your inventory levels have increased. Is this because you have recently stocked up for the holiday season, or is the increase in inventory because your stock is slow moving/obsolete? While the former situation is favorable, the latter could mean that you may soon have to write off a part of your inventory.

You simply wouldn’t have the ability to notice these issues, let alone correct them, without the aid of regular balance sheet reviews. Don’t skip this step or you’ll be sorry!

Make sales tax payments

While it may seem cut and dry, the truth is that sales tax can be a complex subject. It’s a tax imposed on retail sales by some state and local governments, but your company may be required to collect it from customers and pass on the payment to the government within the stipulated deadline.

It’s definitely a good idea to seek professional help if sales tax is applicable to the goods and services that you sell. You can read the Small Business Administration’s Sales Tax 101 for Small Business Owners for more information if you feel lost.

Manage income tax payments and tax returns

When it’s tax season, you will be required to furnish the details that will help your accountant prepare your return. As I mentioned earlier, it’s highly recommended that you plan ahead in order to avoid a last-minute rush. In fact, you can save a substantial amount of time and money by familiarizing yourself with the tax deductions that are available to small business owners.

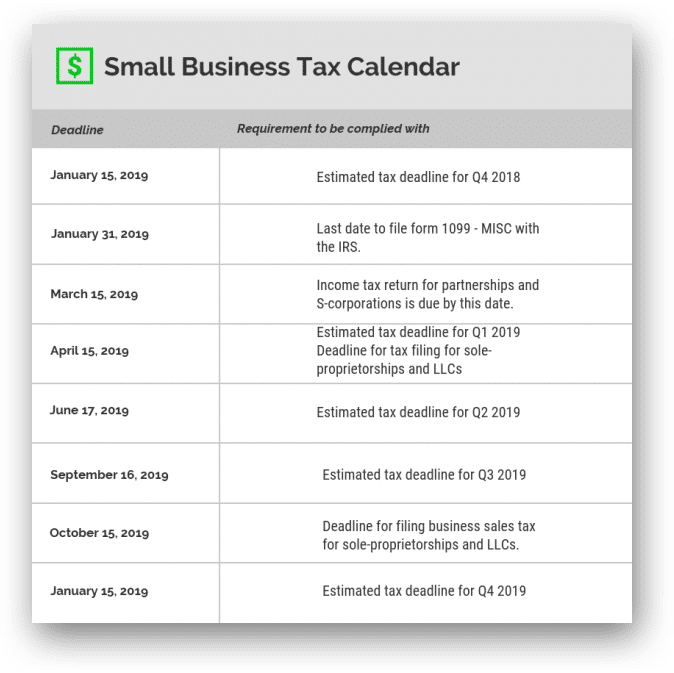

Most of all remember to file your returns on time. Here’s a small business tax calendar that will help you to keep track:

You can get additional details from the IRS Tax Calendar.

More information on Business Tax Forms

Most small business owners require professional help completing their tax returns. However, if your business volumes are low and you don’t have any inventory or employees(as well as some other conditions), you might be able to complete a Schedule C-EZ yourself. The full list of eligibility conditions your business needs to meet in order to use Schedule C-EZ are provided on the upper part of the form.

Other small business owners will need to use a Schedule C. Remember that this form is applicable to sole-proprietorships. Additionally, you can get more information about this form from the 2018 Instructions for Schedule C published by the IRS.

Here’s a link to the IRS website’s page with details regarding tax forms that are applicable to sole-proprietorships.

Do Your Accounting Right From Day One

All the previous tips are geared toward owners of small businesses that are already established. But what if you’re starting from square one?

At the very beginning of a new business, one of the critical areas that you must remember to focus on is your accounting. You’re making a big mistake if you put off thinking about this aspect of your startup until the end of the fiscal year approaches and it’s time to file your taxes.

Therefore, here are some steps that all new entrepreneurs should take to avoid making this mistake:

- Decide whether you will function as a sole-proprietorship, partnership or an incorporated company.

- Open a business bank account. You should conduct all your business transactions using this account; if you use your personal bank account for your company’s transactions, you could have a difficult time at the end of the year when you will be required to calculate your business expenses.

- Keep track of your business expenses. The amount that you spend might be tax-deductible but you may be required to provide relevant receipts or other documentation to back your claim. Make a habit of carefully storing all your receipts; you might even want to develop a filing system that allows you to access relevant records when you need them.

- Select a high-quality accounting system. Several software packages are available that can expertly fulfill this purpose; choose one that will allow you to track your expenses, monitor your sales, and manage your cash flows.

- If you are going to hire employees or even part-time workers, you’ll need to develop a method to ensure that wages and payments are made on time. Ensure that you withhold the correct amounts and make payments to the appropriate authorities within the specified deadlines.

Sounds simple enough, right? Obviously, these tips are much more complicated, with a much more involved process than this list describes. So here are some more detailed tips on accomplishing these goals:

Choosing an accountant

It’s more than likely you’re going to need professional help with your bookkeeping tax filing: no offense!

But now you’re probably wondering how to go about selecting an accountant in the first place. What are the attributes you should look for in an ideal bean counter?

For starters, a person who holds the Certified Public Accountant (CPA) qualification could be your best bet. However, hiring a CPA can be expensive, especially in the early period of a small business. Therefore, one option to consider is using a CPA’s expertise on a part-time basis. Alternatively, you can also hire an individual who isn’t a CPA but has the relevant work experience.

However, when you are making this choice, don’t focus entirely on the candidate’s qualifications. Your business can reap tremendous benefits from someone who is proactive that will give you advice that relevant to your operations, even if they aren’t fully certified. Remember that you don’t want someone who is merely a number cruncher; look for an accountant who will help you to monitor cash flows, guide you on financial matters, and function as a business partner.

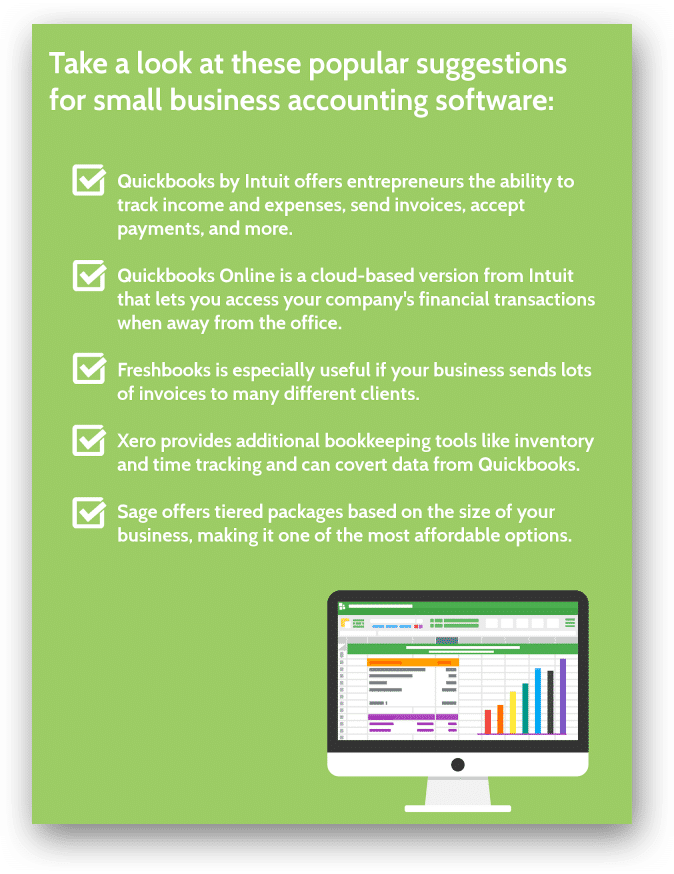

Selecting accounting software

There are several accounting software packages available for small businesses, so making a choice can be difficult. However, the process can be simplified by looking for specific software features that your business needs. Here are some brief suggestions:

No matter what software you choose, don’t rush into making a decision! Most of these providers offer a free trial period; use this and then make a final decision only after you are satisfied the accounting software you’ve chosen meets your requirements.

The Bottom Line

Every entrepreneur should set aside some time to handle his or her company’s accounting activities. You might be tempted to spend all your working hours meeting clients, drumming up business, and taking care of operational issues. After all, these are the actions that generate revenues and profits.

However, you cannot ignore matters pertaining to your company’s record keeping and accounting if you want to keep any of the money you make!

Spending time with your accountant and familiarizing yourself with your firm’s financial statements can provide tremendous benefits. You will understand how your business decisions impact the company’s cash flows and its profitability. Consequently, gaining a basic understanding of how taxes are computed could help you to maximize your deductions and boost your net income.

Finally, remember that a business owner who understands finance and accounting has a far greater chance of success than someone who doesn’t have any knowledge of these areas.

Good luck! Now get out there and make some money!

Accounting Cheat Sheet Frequently Asked Questions |

|---|

| What is basic accounting?

|

| What is the basic accounting equation?

|