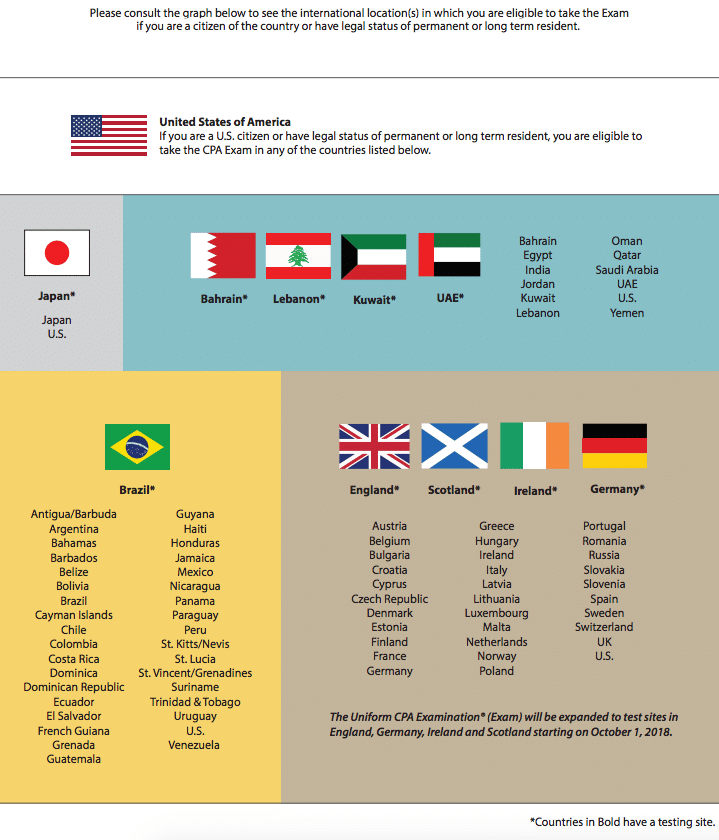

Until recently, international candidates who wanted to acquire the CPA credential had to travel to the United States to take the exam.

But since 2011, the CPA exam has been offered in other countries as well. This is a boon for those who don’t live in the U.S. and want to acquire this prestigious qualification.

American expatriates can take the exam in one of the many international cities in which it is offered. This facility is also available to candidates from other countries.

But what if there is no test center in your country? In that case, you can take the exam in a nearby country.

Let’s understand how international candidates can take the CPA exam. But before doing this, it’s important to familiarize yourself with the different institutions that will be involved in your journey to becoming a CPA:

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2026

- Gleim CPA Review Course ◄◄ Most Practice Questions

- UWorld CPA Prep Course ◄◄ Best Video Lectures

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Lambers CPA Review Course ◄◄ Best Testing Software

| State Boards of Accountancy – there are 55 state boards; a CPA license can only be issued by one of these state boards. Any individual who wants to take the CPA exam has to apply to one of these state boards, each of which has jurisdiction over a specific territory.

Some boards do not participate in the international administration of the CPA exam. These are:

International candidates should apply to one of the state boards that is not listed above. AICPA – The American Institute of Certified Public Accountants – this is the body that prepares the examination questions for the CPA exam. It is the national professional organization of CPAs in the United States. NASBA – The National Association of State Boards of Accountancy – the 55 state boards are members of NASBA. This organization plays a role in regulating the accounting profession in the U.S. The examination results are routed to the state boards through NASBA. Prometric – this body conducts the CPA exam in the U.S. and at the international locations as well. |

Where Can International Candidates Take the CPA Exam?

The Process For International Candidates

If you’re an international citizen interested in becoming a CPA exam candidate, these are the steps you need to follow:

Step 1 – Select a participating U.S. jurisdiction

Remember, nine jurisdictions do not participate in the international administration of the CPA exam.

Therefore, you will have to apply to one of the state boards that do permit international candidates to take the exam.

Which are the documents that you will have to submit to the state board of accountancy that you choose? NASBA provides International Evaluation Services to help candidates who are not from the U.S. with this requirement.

Step 2 – Contact the board of accountancy

Get in touch with the board of accountancy that you have selected and obtain the application materials from them. Submit the completed application. At this time, you will have to pay the fees specified by the state board.

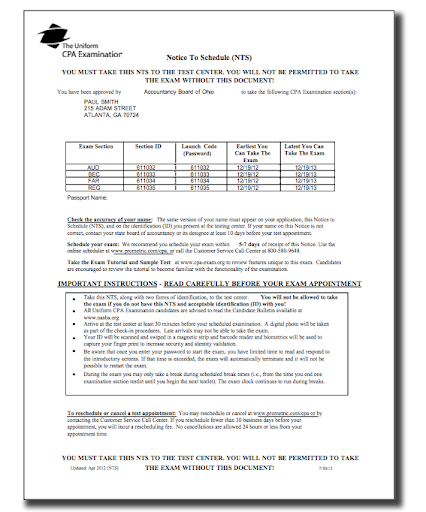

Step 3 – Receive your Notice to Schedule (NTS)

If you are eligible to take the CPA exam, NASBA will inform you that you can print your Notice to Schedule (NTS) from your NASBA CPA Candidate Account.

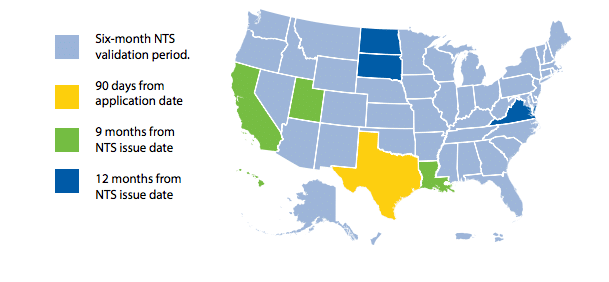

What is an NTS? It is a document that lists the sections of the exam that you have been approved to take. Remember that the validity of the NTS varies depending on the state board’s rules. Although a majority of states give it a six-month validity, the period differs by jurisdiction.

Validation Periods by Jurisdiction

Source – The Candidate Bulletin

What does an NTS look like? Here’s a sample NTS from page 21 of The Candidate Bulletin, a publication that is jointly issued by the AICPA, NASBA, and Prometric.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

Sample Notice to Schedule (NTS)

Source – The Candidate Bulletin – Roadmap to CPA Success – page 21

Step 4 – Schedule your CPA exam

This is the next stage of the CPA exam application process. You can schedule your exam by logging into your NASBA CPA Candidate Account. After you do this, you will have to select the sections that you wish to take.

Step 5 – Make sure the email confirmation you receive is correct

If you have carried out the process of scheduling your exam correctly, you will receive a confirmation by email. It’s essential to verify the details that it contains. This is what you should look out for:

- Is the date on the email the same as requested?

- Are the time and location correct?

There could be multiple test locations in the city in which your exam is scheduled. Hence, you need to make sure that the email refers to the location that you have selected.

How Much Does The CPA Exam Cost?

International candidates have to pay the following in additional fees:

| Section | Additional fees payable |

| Auditing and Attestation (AUD) | $356.55 |

| Business Environment and Concepts (BEC) | $356.55 |

| Financial Accounting and Reporting (FAR) | $356.55 |

| Regulation (REG) | $356.55 |

Remember that you also have to pay the domestic testing fees. These vary by state but are about $200 for each section. Additionally, there is a registration fee (again, it varies by state, but it would be about $300 for all four sections) and a CPA exam application fee (varies by state – it is between $50 and $200). You can get details about the fees for each state here.

Get The Best Discounts On Your CPA Review Course!

Take $1,600 Off UWorld CPA Elite-Unlimited Course

IQEX – An Easier Way To Gain The CPA Credential

International candidates who are members of specific non-U.S. professional associations could become eligible to gain the CPA credential without having to take the Uniform CPA exam.

Let’s break this process down in order to understand how it works:

Firstly, you need to be a member of one of these professional associations:

- CPA Australia

- Institute of Chartered Accountants in Australia (ICAA)

- CPA Canada (CPAC)

- Hong Kong Institute of Certified Public Accountants (HKICPA)

- Chartered Accountants of Ireland (CAI)

- Instituto Mexicano de Contadores Publicos (IMCP)

- New Zealand Institute of Chartered Accountants (NZICA)

- Institute of Chartered Accountants of Scotland (ICAS)

These associations have mutual recognition agreements with the AICPA and NASBA.

The next requirement is that you have to take the International Qualification Examination (IQEX). This exam covers ethics, professional and legal responsibilities, and business law and taxation.

How can you take the IQEX? You can start the process by applying here.

Of course, you don’t get a CPA license just by taking the IQEX. You have to meet the other requirements of the state board where you would like to get licensed.

Additional Information for International CPA Exam Candidates

Here are the answers to queries that many international candidates have:

Do international candidates take the same exam as candidates in the U.S.?

Yes, the exam is the same. There are four papers of four hours each – Auditing and Attestation (AUD), Business Environment and Concepts (BEC), Financial Accounting and Reporting (FAR), and Regulation (REG).

When is the Uniform CPA Exam held?

The Uniform CPA exam is offered year-round as of 2020 in all states except South Carolina. As a result of this transition into a continuous testing model, students can sit for the exam at any day of the year except when waiting to receive scores from previous attempts of the same section. These testing windows are the same for candidates who take the exam in the U.S. and international locations.

Do international candidates need a passport to take the Uniform CPA Exam?

Yes, you do; this is an essential requirement. If your country’s passport does not require your signature on it, you must provide a secondary identification that has your signature.

Can I get an extension on my Notice to Schedule (NTS)?

No, you can’t; nor can you get a refund of your application fees or exam fees. Remember that you can’t reschedule your exam if your NTS expires. Consequently, you will have to apply again and pay the charges a second time.

When will my CPA exam scores be released?

Exam scores for international candidates are released on a rolling basis, as are the scores for domestic candidates, after the AICPA, NASBA, and Prometric adopted the continuous testing model mentioned above. You can expect to receive your score within 1 to 2 weeks of your exam date.

Identify a CPA Review Course That Meets Your Needs?

You can significantly increase your chances of passing the exam if you choose a high quality CPA review course. There are several that are available, and it can be difficult to select the right program.

Fortunately, most of them provide a free trial. It’s advisable to take advantage of this offer and test two or three of the courses that you like. You can make up your mind after you do this.

Good luck!