Cryptocurrency Is Becoming More And More Mainstream. The IRS Is Taking Note — And So Should CPAs

When you hear about bitcoin and the cryptocurrency market, the headlines often concern the price.

Either crypto is skyrocketing, making millionaires overnight — or it’s dying.

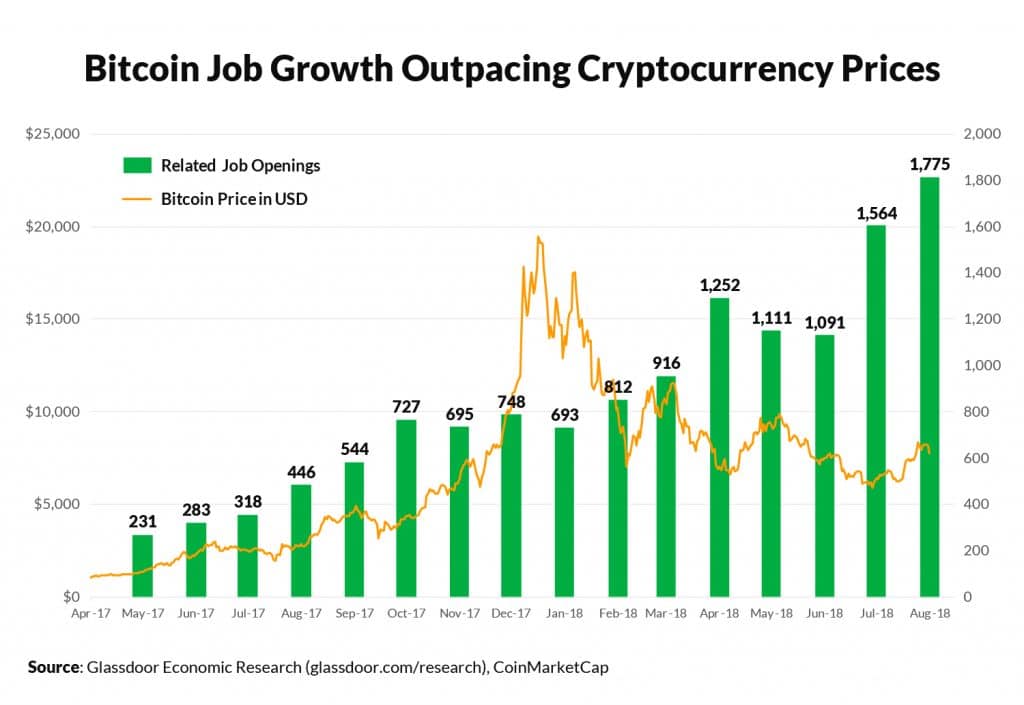

But behind the scenes, crypto job and industry growth continues upwards at a steady pace. Blockchain technology continues to excel, moving its way closer to more mainstream adoption.

Furthermore, financial behemoths, government bodies, and businesses in many fields are all expressing more and more interest in cryptocurrency.

Glassdoor’s economic research blog shows us that job openings for bitcoin related positions (on Glassdoor) have grown by 300 percent. And even with the 2018 bear market, cryptocurrency has risen by ~200 percent in value since August 2017.

See the Top CPA Review Courses

- Becker CPA Review Course ◄◄ #1 Rated CPA Prep Course of 2024

- Surgent CPA Prep Course ◄◄ Best Adaptive Technology

- Gleim CPA Review Course ◄◄ Most Practice Questions

As adoption becomes more widespread, accountants should be getting on board. It’s a complex and lucrative field; tax laws apply to crypto too, and as policy solidifies, cryptoassets may also come under more SEC regulation.

In 2018, financial institutions showed their interest in the blockchain through a number of intriguing hires and projects. Both Goldman Sachs and Morgan Stanley have hired VPs of digital assets. Furthermore, Intercontinental Exchange, the parent company of the NYSE, is forming a new company called Bakkt. With it, they are creating a regulated exchange for bitcoin futures with a particular focus on institutionalization. Additionally, Fidelity is supposedly launching a Bitcoin custody service in March, which will entice those who would be interested in the space but don’t wish to worry about private keys or exchange security.

Crypto is finding footholds in other parts of the private sector as well. Yale’s chief investment officer, who is responsible for the university’s $29.4 billion endowment, has invested into the crypto space. Assets are also being tokenized: in October of last year, a $30 million Manhattan condo building was tokenized on the Ethereum blockchain; hence, the property is now represented by these tokens for sale.

Government bodies (other than the IRS) are taking notice as well. Last year, Ohio began to accept bitcoin for business tax payments. Vermont and New Hampshire have similar plans in the works as well. Overstock.com accepts bitcoin for payment and they even paid their Ohio state taxes in bitcoin.

But what does this mean for the average CPA?

As cryptocurrency becomes more and more relevant in the mainstream, more and more tax clients will have cryptoassets and transactions to report on their tax return.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

And the IRS is going to be strict.

Its new commissioner Charles Rettig stated this past November, “Crypto is no longer cash…It is information data currency that the IRS has, and will have, more information about than you could ever imagine.”

Sounds a little ominous, right? The IRS isn’t playing around when it comes to crypto. Consequently, clients will need help from knowledgeable CPAs.

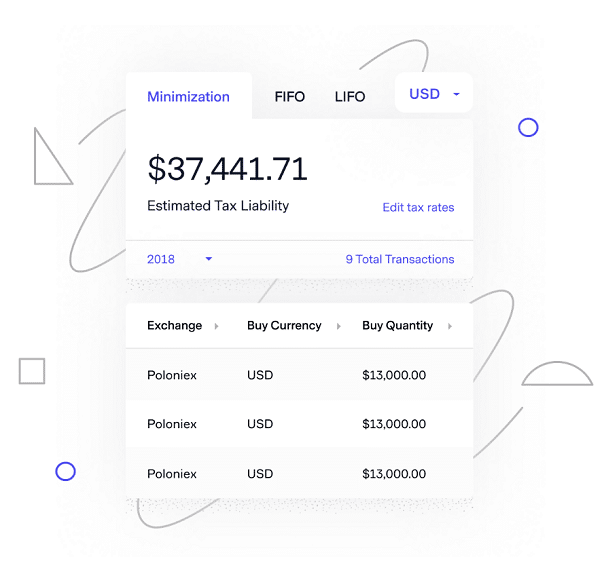

Considering how relatively new blockchain tech is and how complex the still-incomplete IRS rulings can be, clients will require tax preparation and advice. Fortunately, clients can use services like TokenTax to calculate their liability and to generate tax forms.

Additionally, many clients will require guidance beyond just generating tax forms in situations like the use of crypto losses to reduce from other capital gains. There’s no gray area — accountants need to be completely on board with crypto policy considering the IRS’s persistence on the matter.

Here’s some pertinent tax info all CPAs should know when it comes to cryptocurrency:

All crypto assets are treated as property by the IRS as well as many other international tax entities such as the UK’s HMRC. Hence, buys, sells, and trades are taxable events. For example, if you buy 1 BTC at $3,000 and exchange it for 1 BTC equivalent in ETH when 1 BTC now equals $4,000, that crypto-to-crypto transaction still reports a taxable again of $1,000.

Short-term and long-term capital gain tax rules also apply to crypto. hold an asset for under a year and you pay marginal tax rate on it; hold it for one calendar year or more and you pay 0-20% long-term capital gain tax on it. A good incentive to HODL (Hold On for Dear Life), but crypto traders can also be strategic in their trading, just as stock traders would.

Crypto is volatile, and the fun doesn’t stop at the exchange. Furthermore, tax lots work differently for crypto; a share is a share, but crypto can and will be infinitely divisible. Also, keeping track of cost basis is more challenging with crypto. FIFO is the norm for most investments, but the price swings of crypto allow means that other accounting methods like LIFO and specific shares may reduce liability. Average cost can come in to play too for British and Canadian taxpayers, based on their most recent documentation on their crypto tax policies.

Get The Best Discounts On Your CPA Review Course!

Take $1,110 Off Surgent CPA Ultimate Pass

Get $1,000 Off Becker CPA Concierge

Fortunately, TokenTax lets accountants compare tax liability between accounting methods. Our custom minimization algorithm examines all trades and possible cost basis and finds the best possible method for finding the minimum possible tax liability. But even with these tools, many clients also prefer to work with an accountant proficient in cryptocurrency.

CPAs working in crypto should also know about the many situations unique to the field. What if a crypto asset has a hard fork? What if someone receives income in the form of an airdrop (free cryptocurrency given as a promotion) or if they make it through mining? What if they lost coins to hacking or fraud? Furthermore, exchanges all vary in how they report data — data that must be consistent. With TokenTax’s service, accounting organizations can scale their practice in this complex field. However, CPAs are still going to need a solid knowledge base to make the most of this service.

Blockchain technology is still in its infancy, but it’s being watched and adopted by institutional and government bodies. Consequently, accountants on board with this new tech will be pioneers of the field. Possessing knowledge of blockchain technology as well as its associated tax laws can give one an opportunity to work with these forerunners in the field, whether it’s large-scale investors or cutting-edge companies.