Becoming a CPA requires a big time investment and careful planning. Furthermore, CPA candidates must meet specific education requirements and also document any accounting work experience. Hence, you should understand what is tested on the CPA exam and how the test is administered through test centers. Use these tips to earn a CPA license and kick-start a highly rewarding career!

The American Institute of CPAs (AICPA) decides what is tested on the CPA exam and hires industry professionals and academics to write test questions. You’ll take the CPA exam at a test center and it will be graded by the AICPA.

Now: Passing the exam is one of several requirements to obtain a license to practice public accounting, which means that you are a certified public accountant (CPA). You get your license by fulfilling the requirements of your State Board of Accountancy; the website NASBA.org explains the requirements for each state.

CPA Exam Education & Experience Requirements

Most states are moving toward a 150-hour Master’s degree in accounting requirement to become a CPA. Each state lists the number of accounting courses you must take and the types of courses.

Your college advisor can help you plan your course of study to meet the credit hours and other requirements. In lieu of an accounting degree, you may be able to earn a bachelor’s degree in another field of business, then take more accounting courses to earn a master’s degree.

In addition to your college degree, all states require CPAs to complete a certain number of continuing education hours each year.

Additionally, your state will likely have an experience requirement; most states currently require two years of public accounting experience or a longer period of time working as an accountant in private industry. To make this easier, NASBA has an Experience Verification section of their website that you can refer to in order to check specific requirements in your location and more accurately track your progress.

A public accounting firm provides audit, tax, and consulting services to clients; hence, many CPAs start in public accounting before moving into private industry.

CPA Licensing Requirements

The National Association of State Boards of Accountancy (NASBA) helps CPA candidates meet the requirements for their particular state. If you’re an international student, NASBA can help you obtain your CPA designation through the International CPA Examination program.

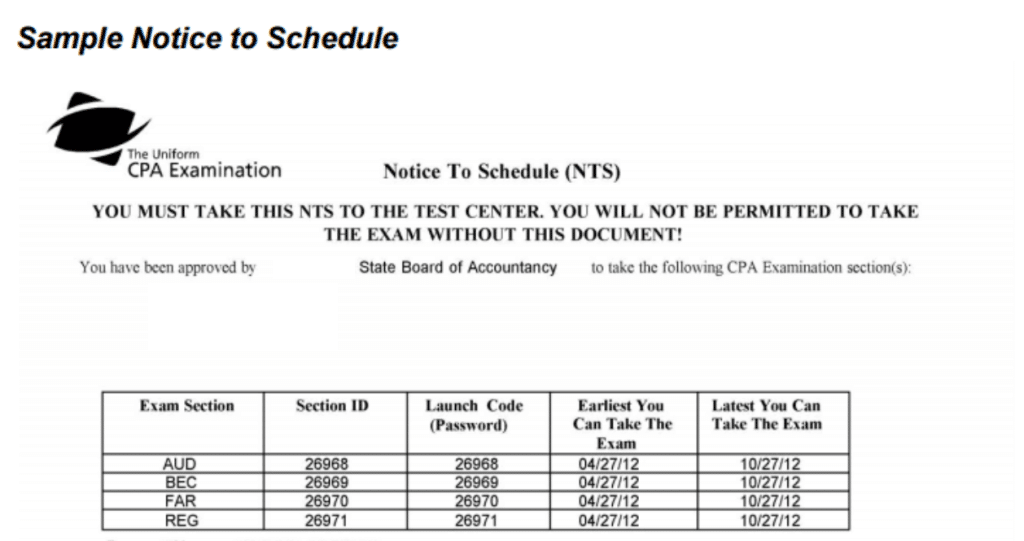

If you live outside the U.S., you can use the internet to find a State Board that accepts international candidates from your country. Download and fill out the application for that state and pay the required fees. When you’re approved, you’ll receive a Notice to Schedule, which is the same process that U.S. exam candidates follow to take the exam at a test center.

Learn More About The CPA Exam

- The Ultimate Guide To The Audit Exam

- CPA Salary Guide: How Much Can You Make?

- CPA Exam Sections & Testing Windows

- 43 FAQ's for CPA's

- Top International Destinations to Take the CPA Exam

Notice to Schedule (NTS)

Both U.S. and international candidates apply to a state board, pay fees, and receive a Notice to Schedule (NTS) when they are approved to take the exam. The CPA exam includes four separate tests; you’ll pay a fee when you schedule each CPA exam section.

You might be wondering:

How does the exam process work? Well, the AICPA CPA Candidate Bulletin found on their website walks you through the test scheduling process.

Preparing for the CPA Exam

There are a variety of resources you can use to study for the CPA exam, including textbooks, flashcards, video lectures, and live test preparation courses. As you plan to study, consider the study formats that have worked for you in the past.

What’s the bottom line?

Some people are self-starters who can diligently prepare on their own, while other students need the structure provided by a video course or live lecture.

The consensus view is that you need around 400 hours to study for the CPA exam. This breaks down to about 100 hours for each of the four sections. The financial accounting and reporting (FAR) test requires a great deal of number crunching. Alternatively, the business environment and concepts (BEC) test has fewer required calculations.

Types of CPA Exam Questions

Each test will include several types of questions:

● Multiple-choice: All four tests include multiple-choice questions, typically with four answer choices. The exam writers are careful not to provide anything in the answer choices that might give away the correct answer. Answer choices are usually the same approximate length and often avoid absolute modifiers, such as “always” and “never”.

● Simulations: In recent years, the AICPA has put greater emphasis on task-based simulation questions. These questions require you to apply a body of knowledge to an accounting situation. Answering these questions is more challenging than answering multiple-choice questions because you have to apply accounting knowledge to a particular problem.

● Written communication: The business environment and concepts (BEC) test requires you to answer essay questions. Hence, you should outline your thoughts before you start to write your essay answers.

You can find sample tests on the AICPA website. Furthermore, test preparation courses like Surgent provide their clients with hundreds of sample questions.

Schedule Your CPA Exam Test Date

The exam is administered through test centers; you can choose where and when you take each test. You’ll take each test on a computer at a Prometric test center and you can schedule your exam through the Prometric website. When you schedule, you’ll enter an ID number from your NTS, and Prometric will send you a confirmation email. Bring the confirmation number to the test center when you take the exam.

If you’re an international CPA exam candidate, you should be able to locate a Prometric center in your country. Furthermore, you must set up your test date at least five days before your selected date and time.

But here’s the kicker:

You must schedule your tests during testing windows, which are during the first two months of each calendar quarter:

● January 1st to February 28th (or 29th)

● April 1st to May 31st

● July 1st to August 31st

● October 1st to November 30th

If you take a test and don’t pass it, you cannot retake the test during the same two-month window. However, you can take all four tests during the same window. Unfortunately, the amount of study required for each section makes this difficult to accomplish.

If you have any special accommodations, check with your Prometric test center to ensure that they can meet your requirements. Additionally, you can cancel and reschedule tests through the website.

Plan for the Long Haul

Work with a college advisor to take the coursework you need to become a CPA and apply through a State Board of Accountancy. Passing the CPA exam requires hundreds of hours of study; therefore, you should plan your time by figuring out how much time you can study each week. Use these tips to pass the exam and earn your CPA credential.